Covestro Cutting Workforce By 10%

Also three IPOs, a big acquisition, and a business is for sale.

Sales and Acquisitions

💯 Arkema announced that they would be acquiring Ashland’s performance adhesives division for about $1.6 billion. The Ashland business will complement their existing adhesives business unit Bostik and I think it gives Arkema access to a lot of new end markets such as automotive and construction. Sources of mine in the company tell me they are excited and looking forward to the deal. Ashland’s executive leadership team wants to invest their time and resources in the healthcare space. The deal is enabling both Ashland and Arkema to become “pure plays.”

♳ DSM announced they are looking to sell their materials business. This includes product lines such as their ultra high molecular weight polyethylene (UHMWPE) Dyneema, which has many of the same applications as DuPont’s polyaramids (Kevlar). Dyneema is really just polyethylene though which means it is lighter than polyamides or polyaramids and its not going to absorb water like an aramid and lose it’s properties. The sale of this business unit makes a lot of sense for DSM since the majority of their business is focused on health, nutrition, and agriculture. Their competition is actually IFF and not DuPont. DSM divested their resins and coatings business to Covestro back in March for $1.9 billion and we can expect them to become more of a pure play company.

🤯 Royal Dutch Shell is selling off Permian Basin assets to ConocoPhillips in a deal worth about $9.5 billion. I take this to be shocking because I didn’t expect it to happen so soon. Shell unveiled their big transition plan back in February which I covered and part of that plan was to use existing income streams to pay for new investments in renewables. Shell said they would be returning about $7 billion to shareholders (appeasement?) and using the rest to “shore up the balance sheet,” which I interpret to mean they are looking to make an acquisition. I suspect chemicals, but it could be a renewable energy play too.

Investments

Aramco is looking to expand their business significantly in sustainability, technology, industrial and energy services, and advanced materials. They have signed 22 memorandums of understanding (MOU) and entered one joint venture. I believe this is falling in line with my prediction that oil companies would be looking to become more like chemical companies as long term demand for oil wanes, which has been accelerated by the Covid-19 pandemic. Here are a few highlights of Aramco’s 22 MOUs. Also notice the reverse logistics opportunities in dealing with waste.

SOLVAY: To pursue the development of advanced Non Metallic Materials and localization of the composites value chain.

VEOLIA: Commercial feasibility of establishing an integrated waste management company. Reverse logistics

Air Liquide & Haliburton & PIF, Baker Hughes & PIF, Linde & Schlumberger & PIF: Carbon Capture & Sequestration (CCS) opportunities. Reverse logistics

Armorock: Feasibility of developing and using non-metallic polymer concrete in the building and construction sector.

Shell AMG Recycling & United Company for Industry: Metals Reclamation and Catalyst Manufacturing. Reverse logistics

Solugen raised $357 million in funding through a series C round led by Singapore’s sovereign wealth fund. If you don’t know who Solugen is this is a good introduction to what they do and what I consider the crux of their technology is here:

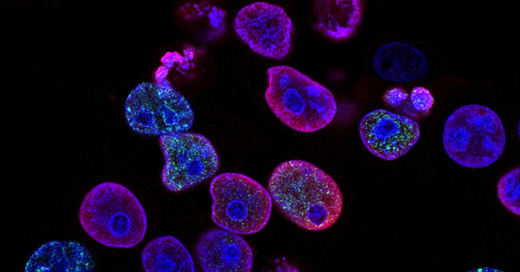

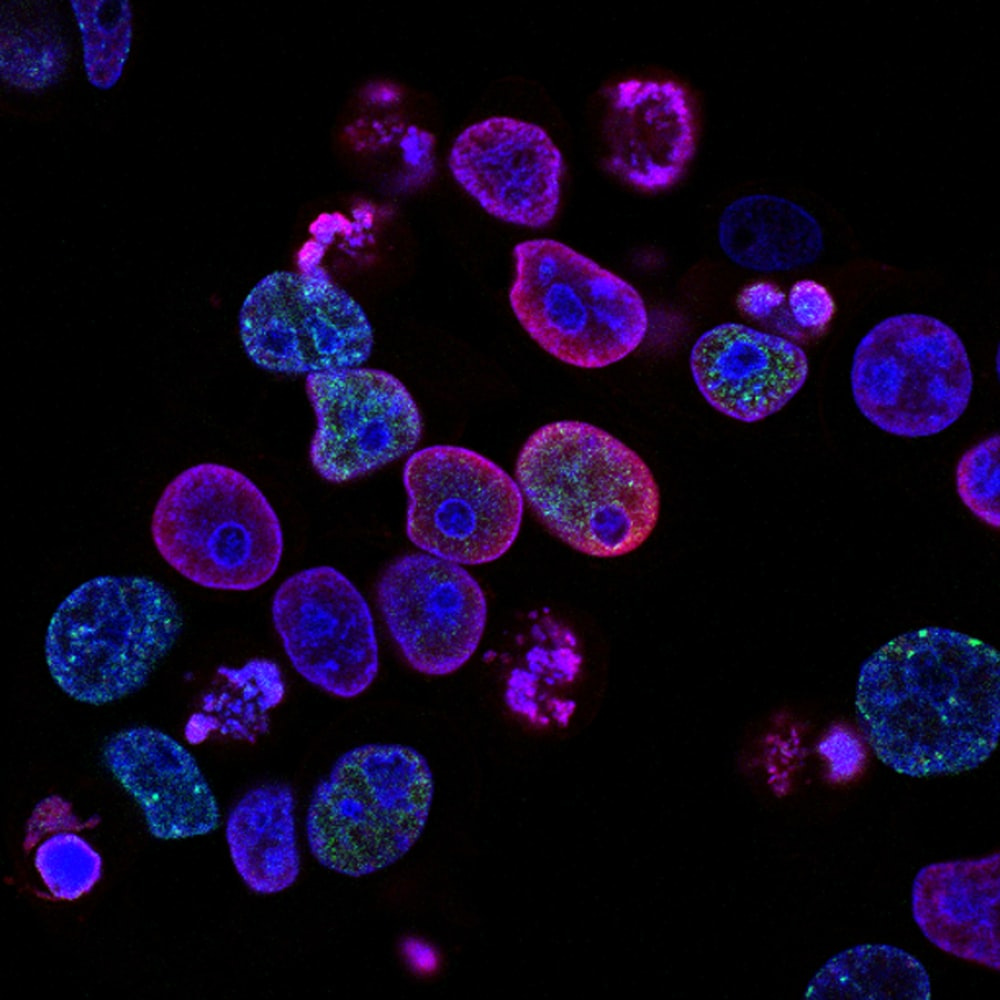

Solugen uses CRISPR gene editing technologies to modify yeast cells. It has identified a certain transcription factor that acts like an accelerant to produce the enzyme that Solugen’s process requires. Messenger ribonucleic acid overwhelms most of the typical processes of a cell to force the cell to dedicate most of its function toward enzyme production. The company then uses a contract research organization to cheaply make the enzyme at scale.

Companies also have driven down the cost of manufacturing these specialty enzymes. “The revolution is the commoditization of biomanufacturing, specifically enzyme production,” Chakrabarti says. “Instead of our enzymes costing $1,000 per kg… It’s $1 to $10 per kg.”

I’m working on a longer form piece for the newsletter about Solugen, how I see them being similar to Novozymes, and trying to understand their true competitive edge. I think my notes from the enzyme catalysis class I took in graduate school are on my Google Drive somewhere.

Initial Public Offerings

Belgian specialty chemical and food ingredient distributor Azelis went public and raised 880 million euros. Azelis plans to use the cash to pay down debt and do some acquisitions and the IPO values that company at just above 6 billion euros.

Nouryon has filed paperwork with the SEC to go public. The company makes and sells oxidizers, polymer additives, ethanolamines, ethers, and sulfur chemicals to name a few. Nouryon plans to use the money to pay down debt. Solugen also makes oxidizers so watch out Nouryon.

Ginkgo Bioworks also went public. The small Boston based start-up has been busy over the last few years and already had a diversified business pre-IPO. Ginkgo is working on using synthetic biology to make raw materials for mRNA cheaper, producing the difficult to source cannabinoid CBG, and they have a turnkey solution for Covid-19 testing that is rapid and easy to administer. If synthetic biology is the new chemical reactor then Ginkgo is attempting to be the preferred control system.

"Ginkgo seeks to make programming the DNA of cells as easy as programming computers. Our platform benefits from scale and the proceeds from this transaction will help Ginkgo expand our platform to better serve our customers and become the industry standard across all biotechnology end-markets," said Jason Kelly, CEO and co-founder of Ginkgo.

Cost Cutting

Management Consultant: You can't cut your way to more profitability. What you need is to hire us to tell you how to grow both organically and inorganically. Can deliver in 6 months.

CEO of a Chemical Company: Hold my beer.

German materials and polymer maker Covestro is planning a 10% cut of it’s workforce which translates to about 1700 jobs globally. Business has been booming for Covestro and its competitors as demand has outpaced capacity. Covestro has fewer employees now compared to the end of 2019. The earnings per share at Covestro have beaten market expectations throughout 2020, but had a significant miss in Q2 of 2021 despite a 7% beat on the revenue targets. Their EBITDA for Q2 2021 was 817 million euros which represents an EBITDA of 20% on revenue, an above average number for the chemical industry.

Covestro’s CEO does not expect the high demand throughout the year despite other chemical company CEOs still expecting strong demand from their customers throughout 2021.

I’ll follow up on this when they report out their Q3 numbers in November.