Europe finds itself in an energy crisis and thus so do the rest of us to some extent. Our global energy market, how we use energy, and where we get energy from is complex and interconnected. Demand in one country can send prices sky rocketing for others. If OPEC decides to collectively act to constrain supply or over produce the ramifications are felt globally. If a country embarks on a mission to eliminate what is perceived as a large safety risk in nuclear power it can have some unintended consequences, especially if Russia invades Ukraine. You get the picture.

Right now we are seeing some of the effects of the ongoing energy crisis in Europe manifest in certain ways:

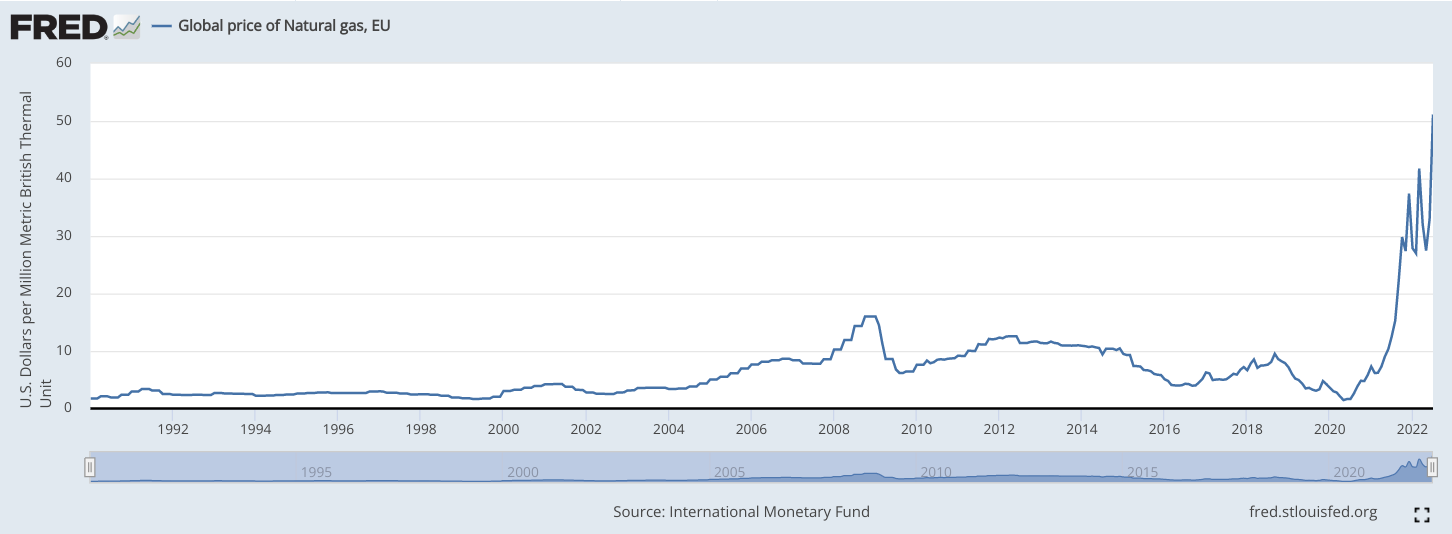

Sky high energy prices for regular people that’s like a gut punch from Mike Tyson.

The chemical industry has been looking at alternative ways to generate onsite heat such as nuclear, liquefied petroleum gas, or certain companies are just considering stopping operations all together.

Shortages of materials

The Lanxness CEO, Matthias Zachert, recently spoke to ICIS about the energy crisis:

“Let’s face it – we have reached a situation where it really cannot get that much worse. The capital markets are factoring in a tough recession – a hard landing. Energy prices have reached a peak – the worst scenario – and therefore there are little further negative shocks that can occur,” said Zachert.

“We see industry players shutting down plants – fertilizer plants for instance. They absorb huge amounts of gas. If all of them are stepping down – the private consumer and industry consumer, demand will go down,” he added.

Sounds like Matthias is a pessimist because he think things can’t get any worse. I’m an optimist because I think there is always room for things to run. Downstream customers (the people who might buy from Lanxness) are already factoring in raw material shortages. I think we should start to see more panic buying soon to get through the next year.

Recent reporting from the Wall Street Journal indicates that companies who use a lot of glass are starting to buy enough supply to last them through the energy crisis. Among the companies buying glass are automotive and beverage producers. I think we should see this spill over into other materials too that are especially energy intensive.

Glass and fertilizers and upstream chemicals are maybe the first to go in terms of shortages, or rather energy intensive raw materials. Companies who buy those things to then sell them to consumers as part of a product will be struggling and will likely start to look into imports. This will especially be true as shipping prices look to be falling over the last few weeks (at least for now). I also suspect that cement will also become significantly more expensive, at least in Europe. Those who can stockpile, will be, and I think we are just starting to see the beginnings of this new (ongoing?) crisis unfold. Remember that the crude oil embargo goes into effect at the end of the year. Are refineries and companies like INEOS ready?

If you are wondering how to predict what will become difficult to source in Europe just think about weight and difficulty to transport and locality. Something like glass is very heavy and fragile so production should be close to consumption. Cement is very heavy and cheap(ish) so it needs to be produced near it’s customers or else transportation costs tend to exceed the value of the product. Chemicals can be difficult to transport and they are dangerous, once again it's a local market. Rubber tires—local production needed. Nintendo Switches and semiconducters will still be imported though.

If you remember, back when I wrote about this in July, Russia was cutting their gas supplies to Germany via Nordstream 1 down to 20% capacity. The US is operating its liquefied natural gas ports at capacity. According to recent reporting from S&P the high European prices are pushing US LNG exporters to produce as much as possible:

While the June 8 shut-in of production at Freeport LNG cut US export capacity by some 2 Bcf/d, or about 15%, this summer, the US' other six operational terminals are making a push to maximize output

To be clear, I think LNG is at best a stop gap solution for Europe, the US cannot export all of the demand from Europe. The demand for LNG will likely also put some pressure on US prices for natural gas as we head into winter. If you are interested in learning more check out this Odd Lots podcast episode via Bloomberg.

If you are an O&G company right now you are making a boatload of money. Record profits are being reported for oil and gas companies like Shell and ExxonMobil. I think the bigger question will be where do those profits flow? If you are a shareholder of O&G you might be expecting a big fat dividend or if you are an activist you might be expecting a bunch of investment into alternatives. Even if the O&G companies put 5-10% of these huge revenues to work in technology development and alternative investments it’s massive. What if they made a Tesla level bet?

Reading about all of this makes me think of how difficult it is to solve these sorts of large complex problems. The majority of our energy evolution has gone from using wood to coal to natural gas to [insert favorite renewable here]. We have always burned stuff to get heat, which we can use to make steam to turn turbines to generate power or we can use that steam to heat homes or to drive chemical reactions forward. I don’t think we have quite figured out how to do all of this with just electricity, but I think huge immediate problems like the energy crisis in Europe are a good catalyst to push new technologies forward.

These short term expensive crises are better catalysts for change than global warming. To those people sitting on the sidelines with technology that might be “too expensive” now is the time to raise some funding. I mean, look at what these carbon capture and direct air capture people have done (hint: it’s bullshit), but if you have a legit new way to make energy or reduce energy use in a specific end market you should be raising money. There is nothing like a massive spike in the current cost of business that scares people into looking for alternatives that might offer a glimmer of hope of future success and relieving short term pain.

Our systems are so complex that even the smallest ideas can be pieces to the larger puzzle. Success in one end market might lead to opportunities in another. We all want to invest in hope.