Exxon's Carbon Capture Plan

Hint: It requires taxpayer money and a carbon tax

There is really only one story I want to write about when it comes to oil and gas this month and that is the Exxon Mobil proposal to do a massive carbon capture project. A few things to note before we get started:

Oil prices have been over $65/barrel for the past few weeks

It appears businesses will start requiring people to come back to the office

People are flying again

Vaccines are becoming more widely available as the demand for them in the US wanes

A combination of economies opening up, people getting vaccinated, and people flying could mean a big resurgence in oil prices. Despite Tesla delivering a record amount of cars in Q1 2021 and all of the other automakers pledging to develop EVs I think oil prices will continue to steadily rise through the summer, but the elephant in the room is potential legislation to curb emissions from the Biden administration and other developed economies around the the world.

Exxon Wants To Capture Carbon. They Just Need Taxpayer’s Help.

The shift in why oil companies might want to start capturing their own carbon in the United States is due to a change in legislation that occured last summer and was reported by Brad Plummer for the New York Times. The new credit incentivizes carbon capture to the tune of $50 per ton of carbon dioxide captured and pemanently stored and $35 per ton if used to pump more oil out of the ground by a technique known as “enhanced oil recovery.”

Christopher Matthews reported for the Wall Street Journal that Exxon Mobil was starting to consider carbon capture to become a viable business method back in March. Matthews reported that Exxon Mobil was forming a business unit to develop an economic plan to realize carbon capture as part of their business. This is really the first significant move in my memory of Exxon taking steps to curb their emissions, which has also taken place after intense shareholder pressure to do so including some institutional shareholders divesting their shares in the stock.

Exxon Mobil’s stock has seen significant decline since 2017 where it was over $100 per share and has recently seen a resurgance from a low during 2020 to about $61 per share. From a share price perspective Exxon has not done well by shareholders over the last five years. The announcement of this new business unit could be their chance to capture the ESG investing wave and ride it to higher share prices and a future where Exxon is a zero emissions company.

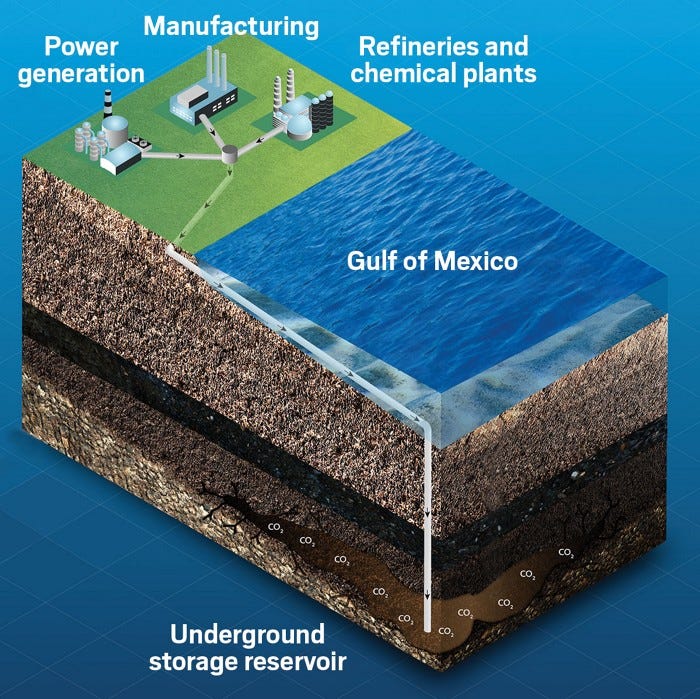

First, they just need some money from the US government. Clifford Kraus reported for the New York Times that Exxon would like to capture carbon from manufacturing plants in the Houston Ship Channel and funnel it to a carpture site under the Gulf of Mexico. According to a press release Exxon is hoping to raise $100 billion dollars from industry and government to get the project funded and capturing carbon. The goal is to capture 100 million tons of carbon every year and at $50 dollars a ton is equivalent to $5 billion and if we assume a 10-20% margin this could be a nice business for Exxon and their shareholders if the government helps them de-risk the investment.

Alex Scott for Chemical and Engineering News wrote:

Absent CCS, producers and users of fossil fuels could struggle to meet future regulations intended to help countries comply with the Paris accord. “Without CCS, the window on oil is closing,” says Jon Gibbins, professor of CCS at the University of Sheffield. “You can use fossil fuel, but then you have got to clean up after.”

The other piece of this would be a tax on carbon which would further incentivize Exxon to enter the carbon capture business too. If the United States set carbon taxes at $50 a ton or more this would further incentivize companies to have Exxon come in and set-up some carbon capture infrastructure to reduce tax liabilities. The big issue with a carbon tax is that the states where it would need to be implemented it is a long shot (i.e. Texas).

What I think could supercharge the carbon capture business would be a market to sell carbon dioxide much in the way that oil and gas is already sold. I’ve written about this before, but the idea is essentially that carbon dioxide and methane could become a new chemical feedstock that could be utilized to make things like polymers, which Covestro and Novomer are already doing. Geoff Coates’ group at Cornell is also doing some great work in the space of utilizing carbon dioxide as a chemical feedstock. If anyone knows of more let us know in the comments.

This is an instance where Exxon could be paid to extract a new raw material, store it for a few decades until the market for carbon dioxide based materials develops, and then turn around and sell it. This is also true of all their competitors. Hopefully they won’t need government investment to do that too.

Talk to you next week,