Future Science Job Abundance

Trying to figure out where investors are making bets and riding that wave of capital into your next job or maybe starting your own company.

This issue of the newsletter and the next three are sponsored by:

I’ve been thinking about what it means to be a scientist today in 2022 and what it might mean to be a scientist in 10 years in 2032 and what it meant to be a scientist 10 years ago in 2012. I think as humans we are unreliable in forecasting out ten years, much less thirty years into the future, but I think we are good at looking into the past. We know what the jobs of scientists were ten years ago or longer because people lived through those times and can speak to those experiences.

So how should we think about predicting the future for being a scientist, especially if we want to have a career as a scientist for about 45 years?

As a polymer chemist looking back to when I was synthesizing polymers in 2009-2012 I think I saw the role of a scientist as being very lab dependent. At the time I saw a fundamental problem between where we got our polymers (oil) and how we disposed of them (mostly landfills). At the time I predicted the future would be in sustainability and I thought Cradle To Cradle was amazing so when I was aiming for graduate school my values centered on sustainable polymer chemistry. For the most part I think I was right, but when it was time to get a job in the chemical industry there were not a lot of positions available.

In immortal words of Chemjobber:

What's the job market like for chemists? Dude -- it's always bad.*

(*For the literal-minded, this is a joke. Mostly.)

This is why a significant portion of this newsletter is dedicated to being a career scientist and why I love having sponsors post jobs in this newsletter and why I try to actively post #chemjobs on Twitter (@tpolymerist). My own frustration in part is also why I try to understand for myself what exactly is happening in the chemical industry. The direction of the business dictates the human capital requirements.

When I started writing this newsletter I felt that the chemical industry was at a tipping point or a precipice. Either things would fundamentally change from a shareholder and management perspective or hungry venture capitalists and start-up founders would seek to disrupt a highly regulated and capital intensive industry. I think we are seeing both happen at the same time.

Bifurcation - The Haves and Have Nots

From what I can tell in my own reading and experiences the chemical industry tends to bifurcate into the “haves” and “have nots.” The “haves” are typically large, well capitalized, and very profitable (EBITDA ~ 19% or higher) and can afford to invest in long term R&D that will provide long term growth and value. These companies can walk and chew gum at the same time because not only can they invest to hit the homeruns, but they can also do incremental innovation to stay in leadership positions in their current products and end markets. The “haves” are playing the short term zero sum game of right now and the long term game of true wealth creation. They are just very selective in what home runs they want to try and hit.

The “have nots” are often less profitable (EBITA ~18% or less) and they are playing a zero sum game. For the “have nots” to win additional market share someone else typically has to lose that market share. The “have nots” are focused on cost and maintaining their profitability at all costs. Everyone is expendable to a “have not,” including the executive team. These are the situations where you might have one scientist doing product development and supporting a $100 million revenue business. Typically, these are the types of scientists that have an ever expanding job description and they might find themselves writing technical marketing material. The “have nots” are trying to keep the boat afloat a little bit longer, usually until they get acquired. If it feels unsustainable to work at a place like this then trust your instincts.

I’m not alone in this opinion. The Accenture Chemicals Practice has also come to a similar conclusion:

Today, in-house research and development (R&D) is focused largely on incremental improvements to the properties of existing materials. Innovation in chemical processes to reduce GHG emissions, for example, is trailing material-related innovation significantly. For chemical companies, basic and applied research typically represent higher risk and longer-term payouts, while incremental developments that focus largely on modifying existing products tend to offer faster, more certain returns—and are seen as the “safer bet.”

In the United States, that attitude is reflected in a 9 percentage-point decline in the basic and applied research share of the industry’s total R&D expenditures between 1990 and 2020, in favor of incremental development.2

The lack of investment into innovation is a definite sign that capital managers aren’t really sure what to do because their thinking is often on too short of a time scale. When I write “investors” I mean current shareholders of the chemical industry. There are plenty of venture investors looking to take a piece of a chemical industry pie and they want to make a boatload of money while also in theory trying to do fundamental good in the world. If chemical industry shareholders want to see industry disruptive EBITDA percentages in their companies they need to fund the development and products to get there. If investing 2-3% of revenue into R&D is keeping the boat from sinking then above 4% should be considered the minimum for meaningful long term growth.

If you have no idea what “home runs” mean or what incremental innovation means I’ve written about it in-depth here. Essentially, the modern chemical industry is built on huge innovations that happened early to mid twentieth century such as inventing Nylon or Epoxy Resin and it has become more difficult to find those types of home runs and bring them to market. There are numerous reasons for this such as The Nylon Problem which Jon Siddall talks about at length in the ACS Industry Matters:

The issue we face in mature industries like the chemical industry is that we are capability rich and target poor. There is a material solution for almost all large applications. We can make almost any molecule you can draw – for a price. Please don’t misunderstand - it is certainly not time to close the patent office! What we need is new applications for materials and not so much new materials for existing applications. Because of this maturity, the opportunities to make truly new materials are less at this point in history. There is a simple reason for this, and it is due, to all things, a simple dimensional analysis or the Square-Cube law. This makes large scale processes win every time and in turn limits materials innovation.

Equipment that can process 100 times as much material usually is only around 100^0.6 or 16 times as much cost to build. A new material is made on a small scale and cannot compete with a large-scale incumbent on price. With each advance in materials, it is more difficult for the next generation of materials to be enough more valuable to overcome this cost disadvantage. I have worked on materials that are superior in many ways to what you use today, but they cannot grow commercially for this reason. It’s not a technical problem as much as a business problem. And today’s materials are mostly “good enough” When’s the last time a plastic object unexpectedly let you down? Globalization makes this even more daunting since production of existing materials moves to low cost places, making them even harder to displace.

A Message From My Sponsor

See how you can boost your chemical commercialization in unfamiliar markets

Entering new markets is a long and risky journey.

What are the market needs? What are the best applications to enter? How to reach the right contacts within the right companies?

Download the case study to find out how a large American supplier saved 2 years to enter unfamiliar coating markets with a new ingredient.

Finding New Targets

If we think about targets for chemical companies they should ideally be high growth areas where there is not a lot of competition. In the last 5-10 years there has been a phenomenal amount of investment and interest in chemical recycling of plastics and I suspect there will be even more in the coming years. Eastman is investing over a billion dollars and Indorama Ventures is investing 8 billion dollars into recycled polyethylene terephthalate (rPET). Dow, Exxon, and Shell are all investing and looking into other ways to make ethylene and propylene and pyrolysis oil from plastic waste is a key strategy.

Sometimes finding a new target might be as simple as helping other companies get down the cost curve with known, but expensive materials. Apogee for instance is trying to bring composite manufacturing down the cost curve, which could have second order effects around making lightweight formula 1 level composites accessible to more people. Evonik spent 10 years developing their expertise around fermenting biosurfactants and it’s of significant interest among the personal care product developers. Costs and performance for the fermented and compostable plastics family of polyhydroxyalkanoates (PHAs) have been a difficult road for many, but Danimer is attempting to do it at scale and Bioextrax is trying to help similar companies bring new fermented compostable polymers to market by improving downstream processing. A target worth billions doesn’t necessarily have to be around solving some critical problem that is widely known to the public.

In the chemical industry we tend to think about going after someone else’s market as opposed to creating a completely new one. There are new markets to that company, but they are markets that currently exist and there are new markets that are just waiting to be created.

Here is a list of some problems I’ve been thinking about in chemicals and I think they all have some grounding in climate change. Some are classically old (before climate change was a thing) and by no means is this exhaustive or a non-obvious list. If you know of a company working on bringing a solution to market let me know in the comments. If you’ve got an interesting problem (target) also let me know in the comments.

Water purification with low energy inputs to remove things like salt and/or PFAS

Non-fossil or food based chemical feedstocks (i.e. biomass)

Dual purpose materials such as structural capacitors or anti-corrosive solar paint

Easy to recycle electronic materials

Low energy input fertilizers either at scale or hyper local

On-demand reversible adhesives

The Future of Being A Scientist

I’m a polymer chemist, but if you are a different type of scientist you should have your own list of “big problems” or the sorts of achievements that you know would change your whole end market. These problems are typically really difficult, maybe even impossible, but if you were to solve them you probably know that you could never do it alone and that a team of specialists is a absolute must. I suspect before long a larger portion of scientists will be working for start-ups.

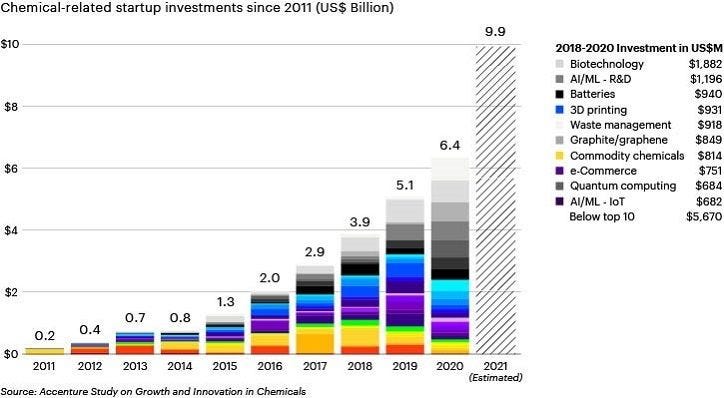

The problem is that I think for the established chemical industry the teams of specialists are slowly becoming more rare, but the place where they appear to be flourishing are start-ups. These start-ups might be doing 3D printing, batteries, biotechnology, carbon nanomaterials, biobased chemicals, or more. The graph above isn’t perfect, but I think it highlights what we might see in the future, and that is a healthy start-up ecosystem trying to disrupt the incumbents.

I also think that money will continue to flow into this sector that many call “deep tech” as digital growth companies continue to go lower in total market capitalization. Digital growth start-ups might be able to solve some of the digital aspects of climate change problems of these deeply technical problems. Maybe a company will figure out a way to sort all of our trash into compostable, recyclable, and landfill streams with robots and Raman spectrometers.

If you a young scientist still in school I think the future is bright and definitely think about the types of problems you want to solve and how profitable it might be to solve those problems. If you are nearing the end of your early career or in the mid or late career stage of being a scientist and you’ve worked in “the industry” then you should be a wealth of knowledge when it comes to product development, commercialization, and getting things done in a corporate setting. For a start-up to get an experienced scientist that knows how to set-up a lab and how to build a product development team this experience will become very valuable.

I think the future looks bright. We just need to build it now.