Economic Impact of Biobased Chemicals.

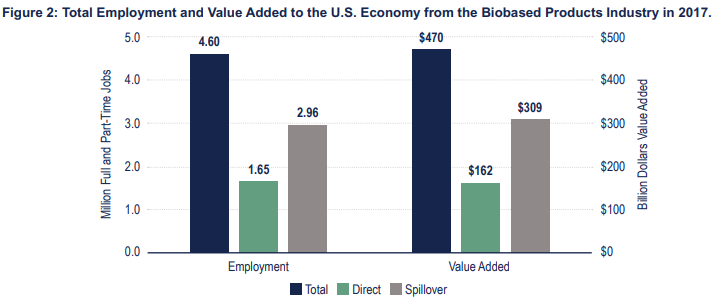

Doris Guzman’s Green Chemicals Blog is typically my first stop when it comes to reading about green chemistry, biobased feedstock chemicals, and forest products chemicals. She had two great stories over the last thirty days the first being the US FDA released an annual report on the economic impact of biobased chemicals. In 2017 there were 4.6 million people employed within the biobased products industry and the sector has generated $470 billion dollars in value. I snipped Figure 2 from the report and it shows how the employment and value add has a very nice spillover effect. Talk about leverage.

There are seven primary sectors where biobased products come from:

Agriculture and Forestry

Biobased Chemicals

Biobased Plastic Bottles and Packaging

Biorefining

Enzymes

Forest Products

Textiles

The report’s authors also go into detail to understand how much biobased content is in the seven sectors they define which I’ve also clipped and shown below.

Biobased chemicals and the plastic packaging and bottles actual biobased content appears to be quite low at 4.0 and 0.28 percent respectively. This makes sense because in those sectors the biobased supply chain is still being established and it's all relatively new. More market demand and more supply will change those numbers though.

Getting the data on these sectors is difficult though, but if enough companies provide transparency into their operations and give sustainability reports that highlight biobased content then we may get a better understanding of how transitioning the economy from oil to biobased products is progressing.

Lululemon Investing In Renewable Fibers

I’ll come out and say it. I’m a fan of some Lululemon clothing, especially the joggers for the winters here in New England. According to Doris, Lululemon is making some big bets on sustainable fibers and thus trying to invest in their supply chain for sustainability purposes. Doris reported:

For its polyester materials, lululemon aims to have at least 75% of its polyester sourced from recycled content by 2025 with a stretch goal of having their polyester materials 100% recycled-based. The company said it will invest in industry development of fibre-to-fibre recycling. Last month, lululemon and LanzaTech announced a partnership to create polyester fibres made from recycled carbon emissions.

That’s not all though because Lululemon has also launched an animal free leather product with Mylo™-- the non-animal leather product from Bolt Threads. Looks like Modern Meadow will have to play catch-up now with their vegan leather alternative. Lululemon will benefit from the short term pain of transitioning their supply chain now since all of their materials are primarily synthetics either in the form of polyurethanes or polyesters. If these bets pan out they will be able to tell consumers that they are one of the most sustainable athleisure fashion companies out there, especially if the market for their secondary products is strong.

Phenolic Resins and Lignin Revisited

A reader pointed out to me recently that there have been two significant advances in using lignin as a phenol replacement in phenolic resins for forest product applications. I wrote about my experience with phenolic resins and lignin from back in 2016-2018 and how I was unsuccessful. While I was not working in the forest products end market two other companies were, specifically UPM and Stora Enso.

Stora Enso’s Lineo is a kraft lignin product that Stora Enso claims can replace significant amounts of phenol in phenolic resins and it is sold as a powder now, but they will be moving towards granules in the future (no one wants issues with dust).

The other company that appears to have succeeded is UPM Biofore and their product is called Wisa Biobond, which is a phenolic resin that contains a lignin. Based on the processes outlined on their website it appears as if UPM is making a low free formaldehyde resole, which is stable during transport and storage, but prior to use as an adhesive it requires a “hardener” to be added to the mixture. I suspect the hardener is some sort of formaldehyde donating adduct that can take place in the crosslinking process.

If any readers have any experience in using Stora Enso’s lignin and can comment on the price I want to hear it. Additionally, if anyone has used the Wisa Biobond adhesive for plywood and can comment on it’s viability let me know.

SK Global Chem Gets A New Name And Bets Big On Recycling

Kartik Kohli reported for Chemweek that SK Global Chemicals is changing its name to SK Geocentric (SKGC). The CEO Na Kyun-soo has plans to transform the Korean petrochemical company to the world’s best urban oil company by recycling and processing plastic waste. The name took effect on September 1st. SKGC will invest about $4.3 billion dollars into about 900000 metric tons per annum of waste plastic processing capacity. The company anticipates a 12% growth in the recycled plastics market by 2030 and they plan to be a leader in South Korea when it comes to circular economy materials.

I wasn’t great at math when I was an undergraduate, but $4.3 billion dollars of investment into circular plastics processing capacity seems like a big deal to me. South Korean companies also came out with a label-free bottle earlier this year, which could help enable high purity rPET feedstocks. Labels are a huge problem when it comes to recycling, but marketing professionals see them as one of the only ways to create brand differentiation (i.e. up charging).

In Spain there is a plan to tax plastic waste going to landfills as well to increase recycling efforts. Having the capacity available to handle the influx of materials in the recycling stream will be critical for Spain to realize the benefits they hope to achieve with the tax.

The Lever

Welcome back to the part of the Friday newsletter where I try to follow some smaller stories that could have big implications further down the road.

Origin Materials went public earlier this year via a SPAC and I’ve written about them previously here. Origin now gives us public updates every quarter and we know that they are using Worley to build its first two production facilities Origin 1 and Origin 2. They have secured $3.5 billion in future purchase agreements from consumer packaged goods companies (CPGs) and it has developed some interesting partnerships with companies such as Ford, Solvay, and Mitsubishi.

It is my sincere hope that Origin Materials can get their plants up and running and can become profitable. If they can do this then I think we will see more companies focused on non-oil based materials being started, going public, and changing our economy to one that is more sustainable.