Oil Down, Chemicals Up, and an Oil Less Future

The majority of extracted and refined oil goes to combustion engines, but what if that demand goes away?

Electric Vehicles Taking Market Share

Clean Technica reported last week that Europeans bought more electrified vehicles (electric + hybrids) than diesel powered vehicles in September for the first time in history. Diesel is not gasoline but this is still a significant milestone for Europe because diesel cars represent about 1/4 of new car sales. While Tesla still leads the way in pure electric vehicles the rest of the automotive industry is starting to make significant gains in market share. The shift to electric vehicles is the start of a major shift in oil and ultimately will influence the chemical industry.

Oil Will Be Needed Less

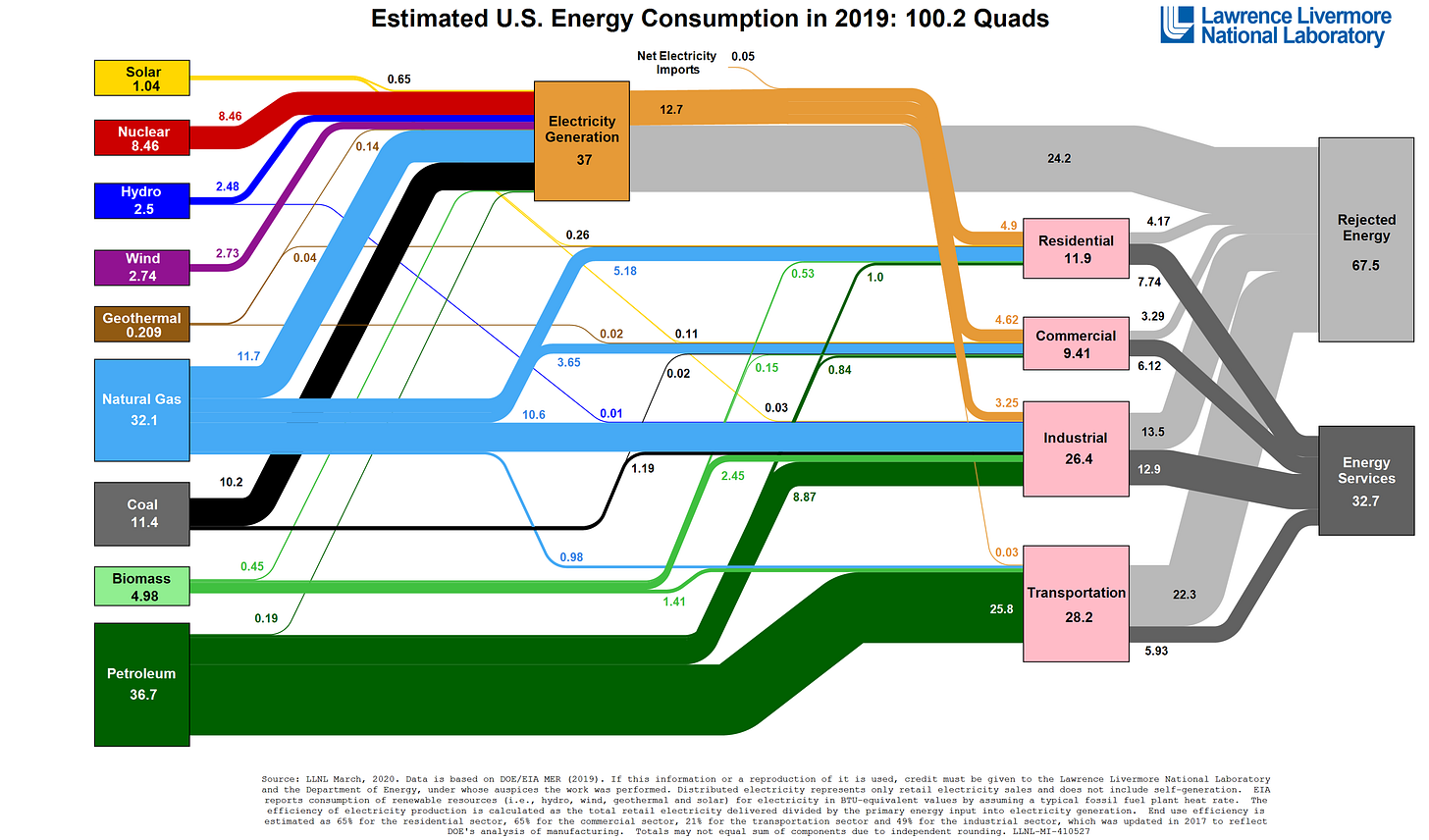

The figure above from Lawrence Livermore National Labs shows energy generation sources and modes of consumption in the United States. The majority of refined petroleum goes to transportation. The year 2020 has been devastating to oil pricing, with negative oil futures occurring, but mainly due to lack of demand as a result of the Covid-19 pandemic. There is an additional public policy perspective with a push for no new sales of internal combustion engine cars within a twenty year time horizon.

California, The United Kingdom, France, and other countries are all looking to phase out the sale of new internal combustion engine cars in the next 10-20 years. It has been theorized that new internal combustion engine car sales peaked in 2018. This means a major end market for refined oil could shrink in the coming years even as demand starts to come back in 2021 for gasoline and diesel. Aviation fuel could still take years to come back.

Bill Gates explains below about how much the United States spends on gasoline per week back in 2016 and how it is more than the clean energy research funding in 2016. If demand for gasoline was reduced by a quarter in the next twenty years the loss in revenue to oil companies would be about $83 billion per year in 2016 dollars. Despite Covid-19 I think demand will come back for gasoline and diesel in the near term, but the shift to less gasoline has been occurring and prices will eventually go down as demand goes down.

Falling Prices are Good…Right?

If demand starts to decline then prices will theoretically follow. This means that it will be cheaper to drive a gas powered car for the next few years and chemicals and things derived from chemicals will be lower in cost as well. This seems good for an internal combustion engine car maker or someone that makes computers, but low prices can also mean a reduction in overall production capacity.

In the near term lower prices are good, but if prices go too low or stay low for too long then the economics of running an already low margin business makes less sense. Eventually, a reduction in oil production will occur to keep prices from falling too much. OPEC infamously kept their production at all time highs during the fracking boom in the US, which caused prices to go down. Frackers filed for bankruptcy and OPEC eventually had to cut production.

This means in the United States hydraulic fracking could be a thing of the past. In 2020 due to Covid-19 hydraulic frackers have been breaking records in bankruptcy court because fracking was not profitable when oil prices hit all time lows (see above graph). There could be further downstream effects in chemicals, which see low raw material pricing as a way to boost profits.

Chemicals come from refined oil and to meet global demand not very much oil needs to be refined (~6-9% of all extracted oil). My concern is that if oil refinement gets dramatically reduced then chemical production could be hurt or even become uneconomical if large integrated sites have to idle certain operations and thus have a negative outcome for the neighboring chemicals business.

Polymerist Predictions

Oil companies will either look to diversify and grow their chemicals business or do bolt-on acquisitions of a chemicals business to grow revenue in the next 5-10 years. Extracting oil, refining it, and turning it into gasoline will only be viable for about the next 15-20 years. An average product development cycle for a chemical company is anywhere from 2-5 years so making acquisitions now or in the near future would give oil companies enough time to get their businesses aligned for a post-Covid and rise of the EV world.

More investments will be made into understanding how to utilize existing plastics as sources of carbon that can go back into an oil refinement process. Clean recycled plastics will become more valuable as getting refined oil out of the ground becomes less economical.

Even more interest will be placed on biorefineries as alternatives to oil refineries and more of the chemical supply chains will shift towards renewable feedstocks not just for marketing purposes, but out of necessity. I will cover biorefineries in more depth in a future Tuesday newsletter.

Covid-19 seems to have accelerated a trend that was already happening in oil and chemicals and I worry that it will too fast for people and their communities to keep up.

The Polymerist

The views here are my own and do not represent those of my employers nor should they be considered investment advice.