Oil Giant Plans Pivot, Non-Wood Engineered Wood, and Sika Invests in The Middle East

The Weekly News I Saw and Thought Worth Sharing

Are you enjoying this newsletter and wonder how you could help me? Consider subscribing or sharing.

Thematic Arc to Watch:

Large Integrated Oil Companies Will Become Vertically Integrated Chemical and Alternate Fuel Companies

I’ve written about how oil companies are going to seek to reposition their businesses to take on more downstream chemicals. Shell released some text written in conversational format with an interviewer here. Shell’s ultimate goal is to be net zero emissions by 2050 and is an ambitious goal for a company that produces fossil fuels. An outline of Shell’s plan to cut emissions can be found here.

The CEO Ben van Beurden’s talks about his plans for Shell in the interview style piece and supports my thesis with this quote:

Refining is another business that we will refocus. It will be smaller but smarter. We will keep only what is strategically essential to us and integrate those refineries with our chemicals business, which we plan to grow. We will keep sites in key locations which have the flexibility to adapt.

To me, this indicates Shell will move to making chemicals from their refineries in order to minimize transport. Transport of chemicals adds about 10% in cost and represents additional emissions. Shell once upon a time made epoxy resins, in fact they were one of the first patent holders on the synthesis, but ended up spinning their business into a company called Resolution and then eventually became Hexion (my old employer).

I also believe that just downstream from Shell to companies like Ineos and Dow should be careful that their commodities business dependent on Benzene, Toluene, and Xylenes (BTX) and ethylene and propylene. Shell could get into making phenol, polyethylene, polypropylene, and other commodity plastics and chemicals.

One of Hexion’s current sites in Europe is still next to a Shell refinery, so I would not be surprised if Shell buys back their epoxy business in Europe, expands into polyols for polyurethanes, and just generally look to find places to put their refined oil with minimal transport.

The other thing I take away from Beurden’s quote above is that they will likely start closing older refineries and non-strategic oil wells. How that will influence oil prices I’m not sure, but I suspect a potential rise in oil and gasoline prices if they truly do cut production and other companies follow.

Medium term plays appear to be investing in integrated gas infrastructures to power natural gas plants and also likely means investment into liquid natural gas or LNG. Longer term plays appear to be investing into off-shore wind farms, solar projects, and probably energy storage (there are other technologies outside of batteries). Outside of the obvious moves Beurden also gave this quote:

Away from the traditional businesses, I talked earlier about the need to work with others and, in some cases, to create new business models, new markets, new customers for the low-carbon products we want to sell. So the new, reshaped Shell will be set up to do that, with a strong focus on helping customers decarbonise and organised around the sectors in which we have customers, like aviation, like shipping, like heavy-duty road transport.

Aviation will remain a key customer for Shell going into the next two decades as will large tanker ships. Heavy-duty road transport may end up belonging to Tesla, their competitors, or potentially hydrogen powered vehicles. Either way, I see the energy markets and chemical markets changing significantly ahead.

New business models. Would Shell look to displace current utilities? I’m not sure Shell has a clear plan just yet, but things need to change in energy if the “duck curve” problem is to be addressed. The duck curve is thought to be due to energy production from solar panels. When the sun is shining less load on the grid is experienced and then when the sun sets the load ramps back up. The problem is that during the peak sunlight hours powerplants may go into operating at a loss due to low energy demand. Grid energy storage would help reduce the dip during the day and shave the peak during the evening. Natural gas powerplants are more flexible in terms of turning on and off to meet demand.

I’ll keep watching Shell and their competitors and explain what I think they are trying to do here.

Innovation

Antimicrobial Bandages

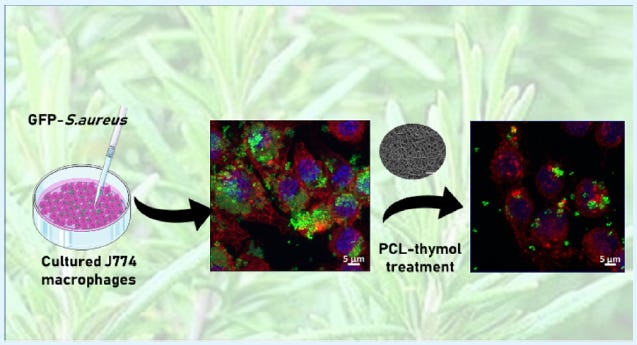

Antimicrobial bandages with Thymol have been shown to reduce growth of Staphylococcus aureus (Staph) and to a lesser extent a Methicillin-resistant Staphylococcus aureus strain (MRSA), which is essentially antibacterial resistant Staph. Garcia-Salinas and co-workers embedded Thymol into an electronspun polycapralactone fibers and reported their results in ACS Applied Materials and Interfaces. Electrospinning is essentially a method of making really small fibers outside of traditional methods such a melt-blown extrusion and is able to better incorporate drugs and active pharmacological ingredients. The active ingredient here is Thymol, which is essentially an extract from the herb Thyme and has been used in pesticides and insecticides according to the EPA. Collagen and thymol based wound dressings have been reported in 2017 and similar systems in 2015.

Seems like these bandages have been reported to work quite well. A box of 25 antimicrobial bandages costs about 100 dollars and contains polyhexamethylene biguanide as the active antimicrobial agent. Thymol likely costs less than polyhexamethylene biguanide, but I suspect there are very few producers or no producers of a GLP/GMP Thymol right now for medical use.

This could be a good business for some chemical engineers. Here is an early synthesis of Thymol from p-cymene, alternatively one could just grow a lot of thyme, do a steam distillation, and fractionate/separate out the thymol. Sigma Aldrich sells 98% purity Thymol at $1/gram, but at scale this might be 5-10x less.

Non-Wood Engineered Wood

The world’s first medium density fiberboard (MDF) based on rice straw was launched in California this week by CalPlant. The rice straw based MDF is called Eureka, is manufactured in California, and is reported to not have added formaldehyde. Woodworking Network reported that the following about CalPlant’s manufacturing operations.

CalPlant manufactures Eureka at the company's $315 million, 276-acre plant site just north of Sacramento. At full capacity, the plant will be able to produce more than 150 million square feet annually (3/4" basis) and use up 280,000 tons of rice straw. All required fiber is procured from a 25-mile radius of the plant.

CalPlant’s patent, US6596209B2, is expected to expire next year because it was filed in 2000. It’s not uncommon for patents to be ahead of their time in terms of commercial viability. A saying I’ve heard before is that “patents give your commercial team time to find a business case,” because sometimes technologies are developed before there is a commercial need.

A careful reading of CalPlant’s patent indicates they are using methylene diisocyanate (MDI) or more likely the polymeric version (pMDI), which is often used as a binder in oriented strand board. The isocyanate binders are used to restrict the formaldehyde emissions from the engineered wood and is something California has been pursuing with rigor. MDI and pMDI are not listed under California’s Prop 65.

Medium density fiberboard and particleboard have historically been made with Urea Formaldehyde and similar amino resins— the main source of formaldehyde emissions California is seeking to restrict.

Business Distillates

Arkema Getting Into Additive Manufacturing with their investment into Adaptive3D. The differentiator of Adaptive3D’s technology is that they are able to print elastomers and soft materials, which will likely be critical for automated handling of delicate goods such as Amazon packages, food, and anything else you do not want crushed.

Sika is Investing in the Middle East with the commissioning of an epoxy plant in Dubai and their acquisition of Modern Waterproofing group. Sika is a Swiss construction materials giant and their investment into the Middle East to me is a signal of a few things. I believe Sika sees the Middle East as a growth area for construction and a need for many of the OPEC nations looking to diversify out of oil based fuel and into chemicals (Just like Shell above). Epoxy resins are also used in construction materials such as concrete primers and anti-corrosion coatings.

Corteva is Dropping Chlorpyrifos due to the multitude of lawsuits being brought against them in the state of California as part of their agreement struck in early 2020, and low demand. Corteva is the combined agrichem and agriculture business of Dow and DuPont. The issue at hand is the use of chlorpyrifos, a known reproductive hazard, on the Prop 65 list, and has received 8 different actions of additional regulation by the EPA since 2000.

What is Chlorpyrifos and Why the Big Deal?

Chlorpyrifos is an organophosphate that was used as an insecticide and pesticide, but started to have less use since the 1990s and early 2000s due to increased regulation and scrutiny by the EPA. Chlorpyrifos has been linked cognitive issues in children. The Counter’s article by Jessica Fu on this is excellent and here is an excerpt:

In the past decade, the chemical has faced scrutiny from public health experts and environmentalists, who have raised alarms about its impact on children and farmworkers. In 2012, researchers at Columbia University published the results of a consequential study that linked chlorpyrifos exposure to cognitive deficits in children. The Environmental Protection Agency (EPA) has banned indoor use since 2001, and it proposed a complete ban on the chemical under President Obama in 2015. In 2017, under President Trump, then-EPA administrator Scott Pruitt blocked the ban’s implementation. (It bears mentioning that prior to the move, Dow Chemical donated $1 million to Trump’s inauguration campaign.)

This is sort of a classic problem with agriculture chemicals. The chemical company invests time and money into new pesticides to increase crop yields, often displacing even more harmful chemicals, only to later find out that these new chemicals are also somewhat toxic or can cause harm to humans. Then a long drawn out battle to regulate and reduce the use of these chemicals goes on for about 10-20 years until finally the demand is so small that the chemical company has to cease production.

While all of this happens it is often the farmers and their workers being exposed to these chemicals and those that live near the fields. Additionally, if you are a farmer who decides not to use these chemicals you fall behind your competitors who do use them. Theoretically, everyone could go organic or not use these chemicals which could also result in making food more expensive and have more blemishes, which also seems like a bad idea due to a significant percentage of the world’s population is food insecure. People also do not like to buy food that appears to have been eaten by insects, which is understandable because we associate these blemishes with rotting or decay.

Agriculture chemicals are unique in that they are applied outside, often by spraying, often near where humans live, and essentially represent intentional dosing of chemicals to the environment. I think we as humans tend to have less issue with this when it comes to fertilizers, especially natural ones, but I believe there needs to be a shift in how agriculture chemical companies, farmers, and governments regulate the space.

Ideally, the EPA would have more ability in restricting these types of chemicals. I believe the chemical industry would be more receptive to the EPA having more power if they were paid to stop production of known chemicals that cause harm. Additionally, activist investors or chemical company shareholder could be a force for change because ultimately companies do things to benefit shareholders.

The other solution would be to move farming that requires pesticides indoors in order to contain the pesticides, but this might result in not even needing pesticides in the future due to better environmental controls. Companies like AppHarvest represent leaders in the space and are located in Kentucky.

I don’t know that much about agriculture chemicals or the agriculture space. It has been something I’ve been reading about more and trying to understand due to a reader asking me to look into it. There seems to be an opportunity here for a disruptive business idea or innovative chemistry solution.

To fix a problem you need to understand it

Tony

The views here are my own and do not represent those of my employer, should not be considered investment advice, and should not be considered medical advice.

This is a great newsletter and I've been enjoying it immensely. Regarding thymol, my suspicion is that extraction from natural sources will never be cost competitive with synthesis. Another major factor is that it has an overpowering "camphoric" smell. A wound dressing incorporating it would need a way to control the odour.