If you want to launch a new synthetic polymer as a product, into the world, then you are in the business of making and selling specialty polymers. The ways you can make your polymer are endless and isn’t actually that important or interesting as long as you can turn it into a viable product that works. This means you can sell at a profit. The higher the profits the greater your genius. If you can beat the chemical industry’s baseline profit structure (I explain later) then you will be lauded as a messiah or the next Elon Musk (pre-Twitter acquisition Elon).

If you want to transition the world economy off of crude oil and onto a sustainable biomass feedstock then you need a profitable product. The fastest way to get a profitable polymer or chemical in the market is as a “specialty,” or not a commodity. I have previously written about specialty chemicals here, here, here, and here. Let me quickly summarize:

A commodity is interchangeable.

A specialty is niche.

Every famous baker starts off with a niche bakery and if they get famous enough, they can decide to commodify their product (Dave’s famous bread) or host a TV show (Paul Hollywood).

Specialties usually command higher profits as a percentage of revenue while commodities often command higher overall revenues at a lower percentage of revenue. A lawyer who specializes in this space once told me,

You would think I would make all my money on the specialty chemicals, but it’s really the commodities. The volumes are just enormous. It’s difficult to comprehend.

Most chemicals and synthetic polymers start off specialities and end up as commodities. Commodities are one step above a utility and innovation here translates to cost efficiency and usually are borne out of immense scale, often driven by wide adoption from specialty areas. Specialty chemicals and polymers lend themselves to all of the buzz words like innovation, invention, customer service, and sustainability. They are special.

For example, chemists at ICIS discovered polyethylene in the 1930s, and the first applications were niche—coating and insulation of wires. Decades later we had commodity polyethylene in two different grades. Low density polyethylene (like a grocery bag) and high-density polyethylene (like a milk jug).

There are only six commodity synthetic polymers in the world:

High Density Polyethylene (milk jugs)

Polyethylene Terephthalate (soda bottles)

Low Density Polyethylene (grocery bag)

Polypropylene (take out container)

Polyvinyl chloride (PVC piping)

Polystyrene (Red solo cup; RIP Toby Keith)

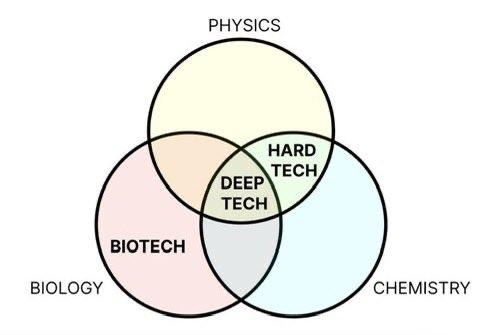

Everything other synthetic polymer is a specialty. These things are akin to cooking where a chemist can develop a recipe that goes on to change the world. Specialty polymers help stop your Tesla and Ford Bronco by binding together your brake pads. Specialty polymers protect your hardwood floors from your furniture, dogs, and children. Specialty polymers keep water from leaking around your bathtub and degrading the structural integrity of your house. They can be used to fix the broken coffee mug handle and bind together the fibers that allow for construction of huge wind turbines (if they ever get past permitting). If you are doing product development in or around chemicals, what the Venture Capitalist community might refer to as “hard tech” or “deep tech,” (see figure below) you should be focusing on specialties or niches.

Ultimately, if you are making something that will eventually be regulated in some way by the EPA and/or USDA then you are really just a chemical company or chemical company adjacent. The way any public market investor will evaluate you will be against the current chemical industry, which is primarily based on a crude oil supply chain and sets the benchmark for success. It’s really simple and based on the percentage of revenue belonging to profit, often referred to as EBITDA margin or % EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization / Revenue * 100):

Best in class specialty chemical companies = 15-20%

Clariant (they are flirting these days with middling)

Middling or distressed specialties = 10-15%

Eastman (they are using adjusted EBIT and “sus”)

Commodity chemical companies = 10% or lower

The question you need to figure out as the new product development team (either as a start-up or part of a big chemical company) is the following:

How do you develop very profitable products that your customers will buy so you can drive that % EBIDA as high as possible due to some interesting chemistry in the lab that lets you make really big molecules (polymers)?

Product Market Fit Conundrum

I hear a lot of early start-up founders in this space of “deep tech” and “hard tech” talk to me about “product market fit,” which is a term borrowed from software.

The term is a bit misleading when it comes to specialty polymers and chemicals because it implies that if you just get the right product then all of the customers will love it and buy it and you will have solved their problem. This framework tacitly implies that most of your customers have the same problem and that a solution that works for one customer will work for a second and the tenth. This is how a commodity chemical producer thinks and it can become a dangerous way to think.

A deeper fundamental issue is that software product development frameworks come from relatively fast iterations and sprints that might take a weeks or months. We cannot do that in chemistry (yet). Software can just generally run on any computer these days, but a highly acidic product isn’t going to do well in a production process that is built from steel because it’s corrosive. Your chemistry might not allow you to change the fact that it’s acidic and your customer probably isn’t going to spend $50 million on equipment that will not corrode (e.g., glass or maybe a composite).

The truth is that each customer in this space (chemicals) often has their own version of “product market fit.” Ikea might take your formaldehyde free biologically derived wood adhesive and use it in a way that’s completely different than a factory that supplies furniture to West Elm. PPG might utilize your diluent in a completely different way for road paint than AkzoNobel might for rail car coatings.

Each customer might need a product developed and tailored specifically for their unique process and application. That product might be 10,000,000 kilograms a year or it might be 10,000 kilograms a year in total volume (yes, we generally use the word volume with weight because it refers to the production volume of your reactors). The fundamental chemistry or biology that underpins the production of those products might be the same, but it’s up to you to figure out how to get there.

Warning. Chemistry heavy stuff below.

Polymer Chemistry as a Platform

One way to think about polymer chemistry is to consider it as a framework or a language. Epoxy resins are one language and acrylics are a different language (the way that C++ and Java are two different languages). Epoxy resins are going to be really good in certain areas like chemical resistance and high temperature performance, but they will almost never have the same weatherability and color performance of an acrylic. A polyurethane foam could be used in a shoe similar to an ethylene vinyl acetate (EVA) foam could be used, but a polyurethane foam could also be adapted as insulation for a building while EVA foam would be a horrible choice. There can be overlap amongst different types of specialty polymers, but they all have specific strengths and weaknesses.

Specialty polymers come from the ability of a polymer chemist to use chemical structure to yield very specific properties in the final system. We often refer to this as “structure property relationships.” If we use acrylics as an example a very simple system might use methyl methacrylate and butyl methacrylate in an emulsion polymerization to yield a basic latex that has a mix of good hardness (from the methyl methacrylate) and toughness (from the butyl methacrylate) but might have a high minimum film forming temperature (e.g., you can’t paint it on when it’s below 70 F outside) that prohibits it’s use in DIY paint that is sold at Home Depot. A polymer chemist could think of two different solutions, formulate in a coalescening agent (e.g., Texanol) or start polymerizing in some longer chain acrylics like lauryl methacrylate, or even use lauryl acrylate (polymerizes at a different rate) to yield more of a blocky lauryl acrylate portion of the polymer chain which might impact how the latex is formulated into a paint and assembles once coated.

Sherwin-Williams might prefer to just buy the methyl methacrylate/butyl methacrylate latex and formulate with Texanol whereas AkzoNobel might prefer using the lauryl acrylate version because it provides a differentiator to them like better abrasion resistance (I’m making this up but guessing directionally) and allows them to not use Texanol. If you work in acrylic emulsion polymerizations, please let me know how close I got to being right here in the comments.

I’ve named 4 different acrylic monomers in the paragraphs above, but there are an almost endless variety you can pick and choose from to yield very specific properties. Just look at Sartomer’s product portfolio for acrylic and methacrylic monomers.

The same is going to be true for phenolic resins. Your variety of polymers is going to be a function of your creativity with respect to phenol type molecules, aldehydes, mole ratios between the two, catalyst selection, and potentially different types of aromatic or aliphatic amines. Put them all in the right combination and you’ve got a new class of polymer call a polybenzoxazine.

Polyurethanes are similar. You can think about using methylene diphenyl diisocyanate (MDI) and a polyether polyol or you could use hexamethylene diisocyanate and the same polyether polyol and get two very different thermoplastic polyurethanes (TPUs). Isophorone diisocyanate will yield something different too. Using an aliphatic polyester polyol or an aromatic polyester polyol will also yield something different. There is a seemingly endless amount of variety you can get by mixing and matching not only how you build your systems, but that you can also mix them.

For example, we could build a polyurethane, cap the ends of our polymer with hydroxy ethyl methacrylate (HEMA) and then polymerize it into an acrylic system. In waterproofing for parking garages these systems are often referred to as PUMA or polyurethane methacrylates.

There are whole textbooks on each polymer chemistry system, and they all have their own little unique quirks. A chemist could spend their whole career working on polyurethanes.

The ability to develop a specialty polymer is usually technically not very difficult. Finding these polymers the right applications for the right customers at the right price with the right margin is the big challenge. Also, if you can do it all correctly your big hope is to achieve the “best in class” profit margins above. If you can exceed that framework, you will be considered a genius.

Innovation in the lab often looks like making new catalysts or making monomers economical that were once perceived to be just a dream. If you can synthesize a perfect triblock copolymer from monomers that couldn’t be polymerized before (and you have almost no diblock coproduct) then the first applications (if there are any) will probably be some niche area. Hopefully, whoever operates in that niche area will be willing to spend the time making your technology work for their process, applications, and customers. If successful, that might mean unlocking new paradigms or concepts that previously were not thought possible and a wild runaway success.

This is why we send samples to potential and current customers. Your customers need to figure out how to fit your product into their product and make their customers happy. If you want “product market fit,” you are going to have to wait for each customer to tell you how your product is either great, terrible, or needs a bit of tweaking (usually it needs tweaking).

Here’s the process that’s been happening since synthetic polymers were invented.

Start in specialty products.

Early adoption results in great traction.

Everyone in that market starts to use your chemistry but with differences.

New competitors enter and compete away your high margins.

Your specialty products feel price pressure and margins get eroded.

Cost cutting happens to boost margins temporarily (layoffs).

Give up innovation engine and focus on operational efficiency.

Specialty product becomes closer to a commodity.

Company sells to a private equity firm.

Slow downward spiral that gets arrested because no one else wants to compete with you and consolidation occurs.

Duopolies form.

Someone has a great idea that could really disrupt this market that has been lacking in innovation.

Start-up founders and new product teams, you might be here right now.

Find a new specialty area that provides more value than what currently exists.

The cycle starts again.

Everything old is new…again.

The limitation on monomers is severe once you start looking at volumes. It's easy (and fun!) to come up with new monomers or ways of using unusual monomers. Super hard to get them at scale, at a cost that does not tank the product launch. I once had a very bright chemist advocating for a silane acrylate that they found in a catalog. I agreed it would do the job, but sent them off to get pricing before we went too far. Very crestfallen bright young chemist came back from purchasing.

The first moral of the story is make friends with purchasing/ supply chain. They can save you from the no-chance work and enable the merely bold.

The second moral of the story is that additives are often more cost-effective than monomers, and have impact at lower amounts.