This week’s Friday newsletter is focused really on one company operating in the green chemistry and circular polymers space: Zymergen

Zymergen is a venture backed startup company that is attempting to change the world of materials and polymers by engineering microbes to produce unique molecules that can be used to build new polymers. Zymergen recently went public through a traditional IPO and in the beginning of August the stock price went off a cliff at the beginning of August.

Zymergen was valued at about $4.8 billion dollars prior to this stock price correction. Zymergen had secured funding from SoftBank and other investors back in 2016 in a Series B of $130 million. It is speculated that the stock imploded due to an SEC filing and that even regulators were skeptical of the valuation according to Angel Au-Yeung of Forbes. Au Yueng reported:

In 2020, the company reported a net loss of $262 million and revenue of only $13 million, the majority of which came from research and development service contracts and collaboration agreements, according to its prospectus.

Zymergen’s current product Hyaline is a biobased polyimide that is aimed at being used in the electronics industry. In terms of product market fit I think that Zymergen had the right end market to pursue with their technology--if they are seeking to commercialize a polymer. The electronics industry is often willing to pay for performance compared to other end markets such as packaging. Further, polyimides are notoriously difficult to process and are sometimes considered thermosets due to processing difficulties. Any new monomers capable of making polyimides better are worth investigating.

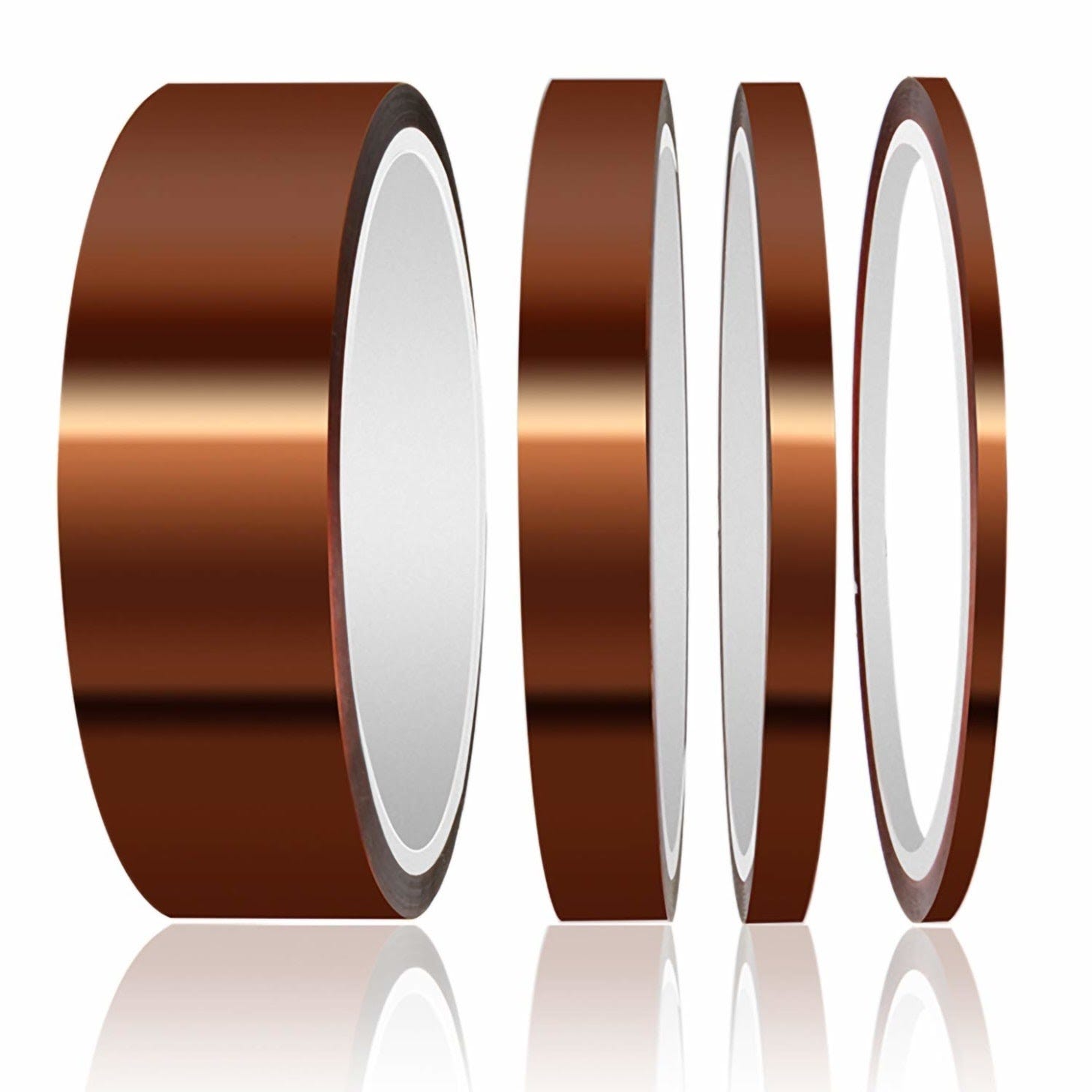

The most common polyimide sold right now is under the trade name Kapton and you can buy some through Amazon. The cost of the tape bundle shown below is about $10 dollars for about 10 oz of material. Let’s say this is priced at about $5-10 per pound depending on the volume you are willing to purchase and Kapton is made by DuPont. In comparison, polyethylene and polypropylene prices last time I checked were at about $1 per pound.

To make things worse for Zymergen a class action lawsuit has been filed alleging that Zymergen misled investors. According to press releases there are many law firms that want to lead a class action suit against Zymergen due to the following transgressions:

(i) during the qualification process for Hyaline, key customers had encountered technical issues, including product shrinkage and incompatibility with customers' processes; (ii) though the qualification process was critical to achieving market acceptance for Hyaline and generating revenue, Zymergen lacked visibility into the qualification process; (iii) as a result, Zymergen overestimated demand for its products; and (iv) consequently, Zymergen's product delivery timeline was reasonably likely to be delayed, which in turn would delay revenue generation.

I think that any experienced investor that has knowledge of timelines around microbe engineering should know more about the product development process. Further, any experienced investor familiar with polymers and chemical investing should be aware of the risks.

So what exactly did Zymergen talk about in their SEC filing that may have caused the stock price to plummet? I will attempt to dissect what I consider to be some key paragraphs of the SEC filing.

I’ll quote the filing and then respond with a paragraph or two on how I interpret that paragraph. This all primarily comes from the Business section of the SEC filing.

Zymergen’s Biofacturing Platform

Biofacturing = Biomanufacturing, a process that utilizes microbes as small chemical reactors that can intake things like sugar, fat, carbon dioxide, and produce target chemicals.

The steps of Biofacturing according to Zymergen:

1. Identify and create novel biomolecules that are the basis of new materials with engineered characteristics that possess improved performance compared to existing products;

2.Insert genes into a host microbe that produces the desired biomolecules; and

3.Develop and scale up a production process including optimizing the microbe to produce biomolecules economically at scale, while retaining product functionality via time-and-cost efficient optimization, leading to commercialization at attractive margins.

I did my PhD with Richard Gross who was successful in engineering a yeast strain to produce an omega hydroxy fatty acid that could be polymerized into a polyester that had properties similar to polyethylene, but was completely biodegradable. The amount of work that it took to get a microbe that could produce the target molecule at the scale required to produce grams of polymer took over four years. You can read the original paper that was published in the Journal of The American Chemical Society. This was back in the 2000-2010 time frame, but things are different now. We have machine learning, faster computers, VC money that needs to be spent, and more hubris.

Doing steps 1 and 2 of the process are in my mind relatively straight forward.

Can you identify some cool chemical structures that could yield some really novel properties in a polymer? Yes.

Can you get a microorganism to produce that cool chemical? Yeah, probably a few micrograms.

Step 3 is problematic. I think it’s where most companies tend to fail especially on the timelines that are expected from venture capitalists because the timing is often longer than anyone thinks possible at all stages of the process. I speak just from doing things the old fashioned way, synthetic polymer chemistry, let alone fermenting a monomer that is going to be used in something like a polyimide. Here is what Zymergen had to say in their filing about the optimization of the microbe:

But the initial performance of the microbe will not allow us to manufacture our product at costs that work for the electronics company. For example the initial microbe may be very slow and inefficient at producing the biomolecule. In order to achieve our target cost of goods sold, we will need to edit the genome of the microbe, optimizing its performance. We pay special attention to “the dark part of the genome”, those genes that are not obviously related to the production of the biomolecule. Based on work done under R&D partnerships, these areas of the genome are critical to commercial success. Our machine-learning systems, drawing on 7 years of data and 200 million proprietary genes in our databases, will suggest variations to the microorganism's genome and our robots will build and test them.

The issues I’ve seen in microbe development without the use of AI, the timelines are something on the order of 1-2 years for microbe optimization for yields if you are lucky. You might not ever optimize the microbe to do exactly what you want. Maybe the microbe wants to mutate and creates a different strain that wants to do something different.

Downstream processing is also another concern. Fermentations typically happen in aqueous dispersion and getting your target chemical out of that fermentation broth and away from the microbe can be tricky. It might even involve a significant amount of flammable solvents.

If Zymergen were to do microbe yield optimization and downstream processing in parallel and get everything to work I think it’s a minimum of 2-3 years without machine learning. Zymergen has machine learning. With Zymergen’s machine learning drawing on 7 years of data maybe they can cut a year off the timeline so I’ll estimate 1-2 years.

Fermentation process development (involving the microbe’s growth and production) and downstream process development (including product purification) will occur in parallel. As the microbe, fermentation and downstream processes mature, we will transfer them to a contract research organization (CRO) and validate the performance at pilot-plant scale. Finally, we’ll begin full-scale manufacturing and our scientists and engineers will confirm the biomolecule works as promised.

Zymergen will contract out the fermentation scale up and downstream processing to isolate their monomer. I suspect that their monomer will need to be isolated via some sort of solvent extraction, perhaps extract any impurities, and then isolated to form a powder or liquid. Doing this in a lab at 5-12 liters is relatively easy given enough time. Doing this at a scale of say 300-500 gallons at a time is more difficult and the longer it takes to purify the monomer from the fermentation the more the costs go up. It could take years for chemical engineers to optimize the downstream processing and get costs under control.

Zymergen then talks about transitioning the process back to their pilot plant. It can take up to a year to get a holding tank installed at an existing chemical plant. It can take longer to get a new pilot plant constructed, especially if downstream processing involves solvents that are flammable (Class 1, Division 1 facility). If you think you can just build a state of the art pilot plant that is going to do fermentation, downstream processing, and polymerization of a polyimide then I’ve got some great beachfront property in Nebraska for sale.

We may choose to accelerate product launch by first entering the market with a non-fermentation derived product and move to full production through fermentation later. As we scale manufacturing, we will also begin sending film samples from our manufacturing lines back to customers for confirmation of both quality and performance.

The fact they Zymergen wrote they are willing to go through a non-fermentation route to me is a red flag. The whole company is based on the ability to do fermentation using machine learning and the moment they go down the route of traditional synthetic chemistry, the target of their derision, means that they do not have confidence in their timelines. To me, this was the mistake because it shows that they are not All-In on their platform. If they go down the traditional petrochemical synthetic organic chemistry route then they are like DuPont, but not as skilled.

Once we reach this point in the process, we will have created a film with breakthrough performance: a material that met the electronics company’s specifications better than anything else available on the market. With this breakthrough material in hand, our business development team will be able to go back to the electronics company and other customers and our broader sales teams will be able to launch the product. We generally expect a 6-18 month customer qualification process for Hyaline and our goal is to shorten this customer qualification process for future film launches.

This brings me back to actually making the polyimide. Once Zymergen has their biomolecule/monomer they still have to make the polymer, which is a non-trivial step. They need to manufacture that polyimide into a usable form that their customers can buy with minimal quality issues at a price that is acceptable to their customers and to where Zymergen is making at least a 15-20% margin. This might not be possible in the next 4 years, perhaps in the next 10, but I don’t think it’s possible in the near future.

Remember, my best guess is that Zymergen is about 1-2 years into the process at this point before they can send samples to customers.

If I was a potential customer of Zymergen and they told me that they were giving me samples of polyimide to qualify from a synthetic route, but that later on they would have one from a fermentation route then I would just tell them to send me the fermentation route product when they have it. The scientists and engineers at any customer only have time to entertain vendors who can produce products reliably and at scale because projects might take 1-2 years.

Just imagine the meeting where you tell your manager that you are working with a start-up who sent you samples to qualify from one route, but that the monomer will eventually be made by a completely different route in a few years. Maybe there is a price that is discussed, but those numbers are meaningless until processes are actually developed. I think after that meeting you would get put on a performance improvement plan.

No one wants to work with a vendor who might not be able to deliver after 2 years of development and who cannot give you a somewhat accurate assessment on cost.

I’ll stop quoting the SEC document now, but I suspect that Zymergen is really more like 5 years away from revenues on Hyaline, their biobased polyimide. I suspect their expertise is primarily in the genetic engineering of microbes, the machine learning piece, and fermentation. They might be able to hire the experience in polyimides from places like DuPont, but it takes a long time to build out the internal business functions and manufacturing facilities required to actually bring a polymer to market.

As a general rule assume any contract manufacturing that Zymergen engages in increases costs by an additional 50% compared to doing things internally.

Investors should have been familiar with some similar stories from the past.

Metabolix was founded in 1992 on making polyhydroxyalkanoates from plants and/or microorganisms. The whole family of polymers around polyhydroxyalkanoates have long held the promise of biodegradable plastics made by nature that could revolutionize the industry, but nothing has panned out just yet. Danimer Scientific is attempting to succeed where Metabolix failed (I hope they succeed). Metabolix had to close everything down in 2017 except for their crop program which is now called Yield10.

Solazyme was another company that was seeking to use algae to make biofuels. They were ultimately unsuccessful when oil prices tanked during the fracking boom that started in the 2010s. North American energy independence was bad business for the biofuels world and Solazyme had to pivot towards high value fats and are now known as TerraVia.

This time is different right? We have machine learning now. We have faster computers. I have HBOMax on my phone and I can have anything delivered to my apartment. I can get a bikeshare to go to the grocery store where I can pay with a touch via Apple Pay.

Now, about that beachfront property in Nebraska...

I was the founding CEO of one of the very first bio based chemical and materials companies and I can attest to how challenging it is to build a recombinant strain that hits all the performance specs, the downstream purification and the chemical catalysis. DuPont and Cargill’s efforts to scale 1,3 PDO and lactic acid, and their downstream polymers are good case studies highlighting the challenges scaling all the core unit operations and also the huge daunting task of developing a whole new material. Customer adoption is a long, expensive and risky endeavor. I wish Zymergen well and they will need way more money, time and the right talent.

I think Hyaline is to be a substitute for colorless polyimide, not necessarily it's polyimide.