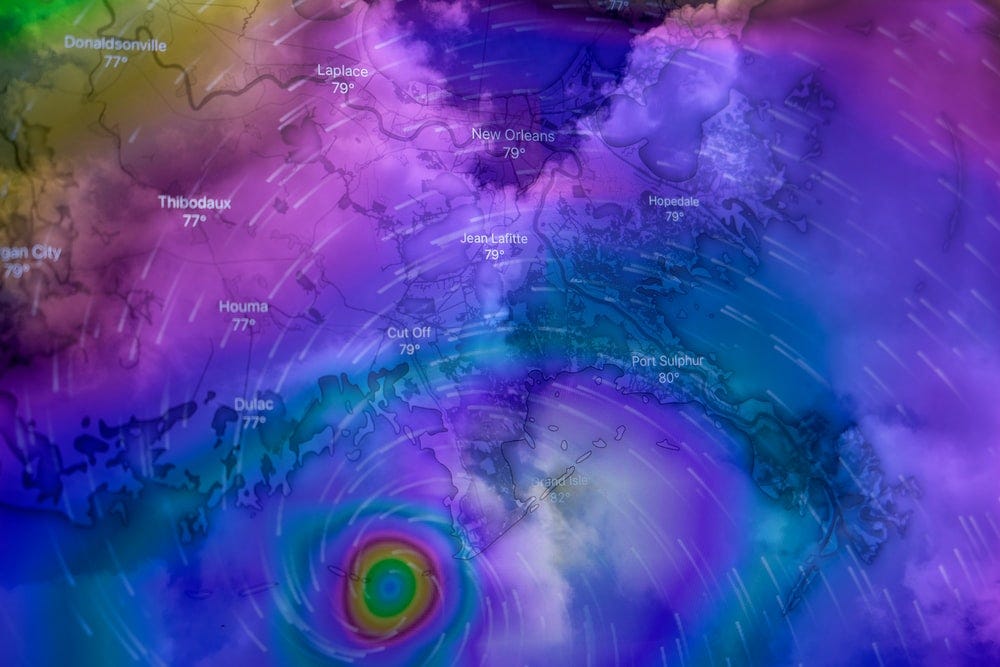

Hurricane Ida

The big story right now in the oil and gas industry is the aftermath of Hurricane Ida. Collin Eaton for the Wall Street Journal reported on how the industry is looking to restart operations after the storm. Power outages have been the biggest impediment to getting operations restarted and for refineries west of New Orleans it could take weeks to recover because of additional flood risks. These oil refinery operations account for a quarter of the capacity in the gulf region and could result in regional gasoline shortages. Meanwhile, OPEC has met and will stick to their plan of increasing production later this year.

In addition to oil refineries being shut down the chemical industry has also had closures. ICIS has been tracking the situation and as of September 1st here is a list of sites that have been offline. In the chemical industry I suspect there to be more raw material shortages and force majeures hitting supply chains in the coming weeks. Hopefully the buyers further down the supply chain have enough inventory to get through the next few weeks. Get ready for higher prices in the short term.

The Carbon Market

Over the course of 2021 I’ve written about how oil companies are looking to diversify their revenue sources and trading carbon emissions appear to be a growing market. Sarah McFarlane for the Wall Street Journal reported that Royal Dutch Shell and BP have significant businesses in carbon emissions trading. How does this work you ask?

Let’s say you are a cement producer in the European Union and you’ve been allocated X tons of carbon dioxide emissions, but you are smart and you figured out some ways to reduce those emissions. You can sell your unused emissions and traders at Shell and BP can help you find a buyer on the open market. Alternatively if you are a steel producer who is going over the permitted emissions then Shell and BP can find you some credits to buy to keep you in compliance. MacFarlane further reported:

The European Union earlier this summer unveiled plans to expand its market, and China has started its own, limited trading system. The Biden administration has said putting a price on carbon is a good idea, but is far behind those two economies in coming up with how to do it.

Analysts at Wood Mackenzie think the value of the carbon emissions trading market could exceed the actual oil and gas market by 2030. This doesn’t make a lot of sense to me right now, but I suspect that government regulations will play a big role in making this happen. I think Europe will lead the way followed by China. I doubt the US will get it together to figure out a carbon market strategy.

The Lever

“Give me a place to stand and with a lever I will move the whole world.” Archimedes

There are moments and instances where certain companies or a piece of legislation or a public policy initiative can have impacts on operations and product development. I am going highlight some here and track them. These could be startups, lawsuits (liability), and/or new laws being proposed (i.e. when the EPA was trying to make a decision about banning the use of DMF).

Carbon Dioxide Is The New Oil

Cemvita is a company that has been on my radar for awhile now and they just closed their Series A funding round, which was led by 8090 Partners. Cemvita is attempting to turn carbon dioxide into chemicals and the first one they are attempting to make is ethylene. I like this because I view it as a relatively elegant separation compared to other downstream processing challenges via fermentation. It will be interesting to see if Cemvita can avoid the issues that plagued Solazyme (now TerraVia) and leverage or license their technology to the oil and chemical industries. Seems like a good partnership for the giant carbon capture project that ExxonMobil proposed a few months ago.

Climate Liability Could Be A Thing.

I’m not here to try and convince anyone about climate change or carbon emissions or the issues around fossil fuels, but the fact that there are 24+ climate liability cases going through the courts right now is significant. If a case is successful in getting to court then there could be a whole new realm of liability for the oil and gas industry around climate change. If it can happen in oil and gas then it can probably happen in chemicals too.