Welcome to the financial transactions issue of the newsletter where I write about the financial deals dominating the chemical industry. If you are curious about the structure of the newsletter go here. I wanted to spend some time to do a deeper dive into the Hexion story because I think the story of Hexion is a microcosm of what has occurred broadly in the industry over the last 20 years and it might be a good indication of where we are headed next.

The Polymerist is sponsored by:

Hexion Inc. has announced that it will split into two companies. One business will be adhesives and Versatics (a specialty additive for epoxy/polyurethanes) and one will be epoxy resin composites and coatings. The adhesives specialty business will go public while the epoxy composites and coatings business will remain private. To me this is a sign that true chemical conglomerates are things of the past (at least for now). I think a few conglomerates might hold on such as BASF, but I suspect that they will also start to divest their non-core businesses in the next few years such as the agricultural business.

Hexion was formed in 2005 from the merger of Borden Chemical, Bakelite AG, Resolution Performance Products, and Resolution Specialty Materials. All of the chemistry was based around phenol which is how the X in the logo above is derived. Apollo was the private equity firm behind the mergers.

Borden Chemical primarily made phenolic resins for the wood industry and some specialty industries such as brake pads and acoustic insulation. Borden Chemical was a spinoff from Borden Foods and it was all primarily based in North America.

Bakelite AG was a German based chemical company that made epoxy resins and phenolic resins with the majority of their operations in Europe.

Resolution Performance Products and Resolution Specialty Materials were the spinoffs from the Shell Epoxy business unit and as the names say were ordered into a commoditized business and a “specialties” business. Resolution had a strong presence in both Texas and the Netherlands.

In 2006 Apollo bought Momentive from GE. Momentive represented GE’s silicones business based out of Waterford, NY.

In 2008 Hexion famously tried to buy Huntsman with the promise that they would divest their epoxy resin business, pulled out of the deal at the last minute, and then had to pay Huntsman a billion dollars. Lol.

By 2010 Apollo decided to merge Momentive and Hexion together despite the two businesses not having much in common and called them Momentive. In 2014 they switched the name back to Hexion. By 2016 the two businesses had split again and then Momentive (the silicones business) would eventually go bankrupt and cause some controversy. Momentive (the silicones business) would eventually be acquired by a South Korean private equity firm in 2019.

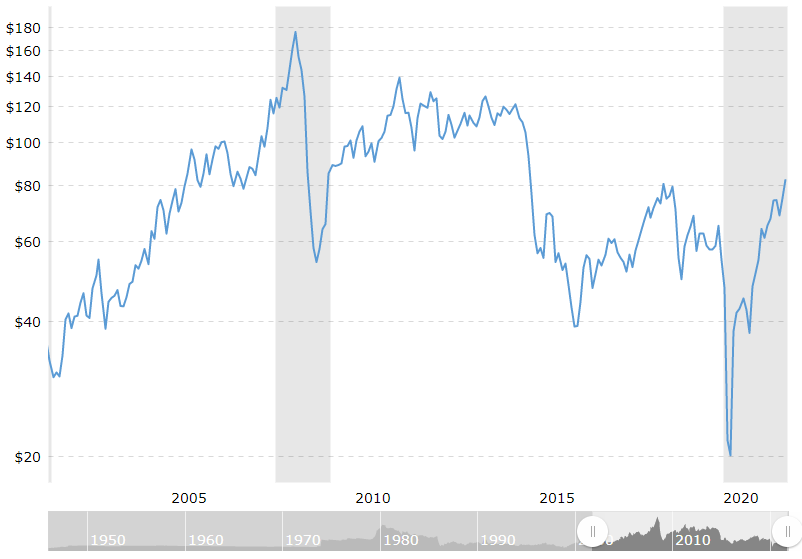

From about 2014 and on, oil prices would fall off a cliff (then again in 2020). This was beneficial from a raw material pricing perspective for Hexion, but it absolutely crushed their oil field proppant business and their customers—the frackers. Cheap oil prices also inverted the economics of most biobased chemicals and fuel companies. The cellulosic ethanol plant that DuPont had built suddenly became a big loser that would get divested during the reshuffling of the chemical industry that has happened in recent years.

In 2019 Hexion went bankrupt as their corporate bonds came due. The company sold their combined specialty phenolics business (Borden + Bakelite = Bakelite Synthetics) in 2020. This brings us back to the beginning of the story where Hexion has announced they are going public and splitting the remaining business into two different companies. What was once 4 companies in 2004 has now become 3 different companies in 2021.

The big structural change that I see here is the consolidation of the specialty phenolics businesses and the pivot of the Borden forest products business into specialty adhesives (formaldehyde based) that also captured the Versatics business. If you are wondering what a versatic is, it’s essentially a mono-epoxy ester based on a fatty acid (fatty acid + epichlorohydrin = versatic).

Where Are We Headed Next?

Was anything gained by shareholders in all of these private equity shenanigans with Hexion? My feeling is no one gained anything from a fundamental innovation point of view, but I suspect that the private equity holders made some money here even with the billion dollar write down to Huntsman.

Based on what I’ve read about and written here I suspect the chemical industry is on a path of simultaneous fragmentation and consolidation. Companies are becoming “purer plays” (e.g. Arkema) and the conglomerates of the early aughts are mostly gone. The concept of being lean will continue to dominate, but the chemical companies need to be careful about talent retention and the War for Talent. Most people want some modicum of stability and safety in their jobs. My hope is that the M&A that has dominated the past decade of the chemical industry will taper off and that we can start to actually focus on developing new products and making the world a better place.

Elon Musk talked about the dangers of over investing in MBA talent. His companies seem to be doing pretty well from a valuation standpoint as Tesla just became worth a trillion dollars.

If we think about the core of what a chemical company is either a pharmaceutical or an industrial company or a start-up, you need to employ people that can actually deliver a new product. A chemical company that cannot create something new will eventually get overtaken by their competition despite any sort of YoY EBITDA percentage growth or high margin maintenance of some existing business.

A Message From The Sponsor

The chemical industry seems like it is changing every few years. About half of all the available jobs out there are not publicly posted and these jobs are often filled by specialized recruiters such as Task Force Talent. I spoke to a recruiter at Task Force Talent when I was negotiating this sponsorship deal and they told me that there are some big named clients looking to fill completely positions for completely new ventures. Specific experience is something that is desired so if you feel like you need a change consider reaching out to Task Force Talent.

Next month’s feature will be The Chemical Company Of The Future.

Tony

If you liked this issue check out previous issues:

Covestro Cutting Workforce by 10%

Great write-up!