Record Profits By Most Big Chemical Companies and Everything Is More Expensive

A review of the first half of the year and the second quarter in 2021

Welcome to the first Quarterly Review issue of the newsletter. If/when I turn on paid subscriptions my intent would be for this issue of the newsletter released every quarter to be for paying subscribers only. Until I go paid I’m also experimenting with what a top tier subscriber might get with construction products company GAF. I haven’t made any money yet, this is a test.

You can find me on Twitter at @TPolymerist

Nothing protects quite like a roof. That's why millions of Americans live, work, and play under quality products from North America's largest roofing manufacturer. GAF is hiring for a Senior Research Scientist based in Ennis, Texas or potentially Parsippany NJ to work on polyisocyanurate foams. If interested, apply online and/or contact the recruiter directly.

Around this time last year (2020) I was worried that I was going to lose my job because the economy was tanking. For the first half of 2021, and Q2 specifically, chemical companies are reporting record profits for the quarter with a perfect storm of relatively low oil prices, high demand, and consumers wanting to spend. Alex Tullo for C&EN wrote about the general record breaking 2Q2021 for C&EN and in discussing BASF, the world’s largest chemical company:

The German company’s commodity businesses, including chemicals and materials, performed better than all other segments in its portfolio, primarily because of higher prices and volumes. Sales in chemicals jumped 91%, while materials rose 75%.

I wrote about the resurgence of specialty chemicals back in May 2021 and how they would be capitalizing on the situation. In hindsight, what I got wrong was that commodity chemical makers would also be capitalizing on the situation. The storm that the chemical industry is weathering right now is one of inflation, lack of capacity to meet demand, and lack of shipping availability. This storm is in many ways great for chemical companies (see above), but it’s not so great for the customers of those companies.

The companies not able to capitalize on this resurgence are paying higher prices than ever for products that have largely remained unchanged since 2019. These high prices started during a massive supply shortage during 1Q2021 where the US saw its main hub for oil extraction, distillation, and refinement into chemicals go offline for a few weeks due to freezing conditions in Texas. The aftershocks of the freeze caused many just in time supply chains to stop moving products and those who had inventory started to command higher prices. To that mix, add in that Covid-19 and the delta variant started surging across India and manufacturing operations that were reliant on low cost labor in India were essentially oversold and beyond capacity.

We are not out of the woods of supply chain nightmares just yet. From an earnings call transcript at GCP Applied Technologies the CFO Craig Merrill spoke about supply chain issues:

As an example, the GCP supply chain has been impacted by 28 force majeure declarations by our vendors globally year-to-date and 14 force majeures continue to be in place as of the end of Q2.

14 force majeures are still in place at the time of the earnings call so there is definite bleed over into Q3. Being far downstream from refined oil products is not a good place to be right now, but companies that are close to refined oil like BASF and Eastman are doing just fine. From Eastman’s Q2 earnings call:

Yes. So, on the specialty side, I'd say our view is, demand is going to be strong and hold up well in the third quarter and continue into the fourth quarter. So, not that normal seasonal drop, as we don't see a lot of progress in customers making sort of improvements in their inventory situation, especially in some markets like automotive or construction and -- those kind of markets clearly are being, sort of, rate limited by supply chain challenges in the way they're serving underlying market demand, which is very strong around the world. And so, they're going to continue to want to, sort of, ramp up production whenever they get raw materials to serve that need.

In some instances the customers of BASF and Eastman might be able to pass through the cost to their customers. This cost pass through is a source of inflation, maybe it’s transitory. Alternatively, these companies downstream from BASF and Eastman may have to absorb the increase in costs, which will negatively impact their margins and may result in cost cutting measures (layoffs, product cost cutting, etc).

Everything Else Is More Expensive—Especially If You Want To Build Stuff

Here in the US we have a labor shortage, but unemployment is still 5.4% and recruiters, at least for chemists, are looking just about anywhere to fill positions. An increase in wages seems like an obvious answer, but shareholders don’t want more pressure on their margins, perhaps it’s better to let positions go unfilled as opposed to raising wages a few percentage points? Shipping costs have increased by 3-4x and getting a container from China to the US costs about $24,000 if you can find one. More on shipping containers here. Chemists and containers are not the only things in-demand though.

There is also a construction labor shortage during an inflation of housing prices and lumber prices, which make the idea of buying a house for many nearly impossible. Pre-Covid lumber was between $300-500 dollars per thousand board feet (this can help you understand board feet), prices peaked at $1500 at the end of May and are currently around $800 in August 2021. Raw material cost increases, a shortage of labor, and a supply chain that is struggling for everything else means that existing stock (houses) are going up in price. Homebuilders cannot build houses fast enough. Low interest rates are not helping either. But wait, technology and growth companies can fix this problem right?

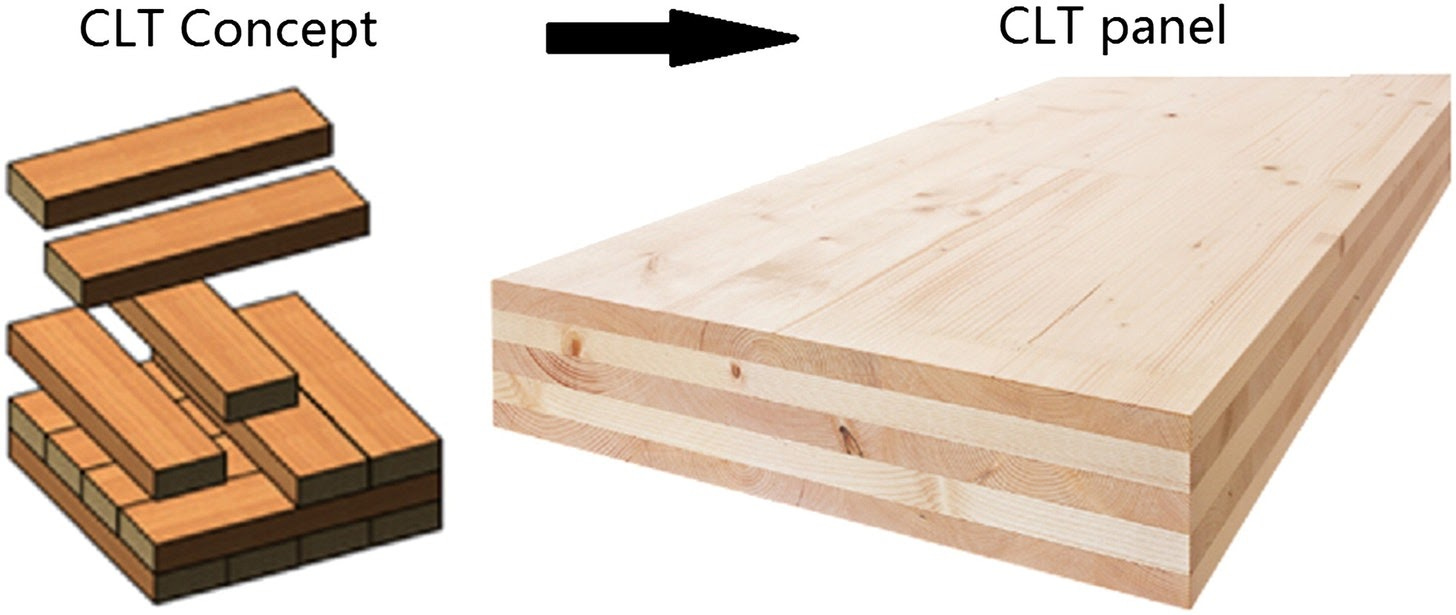

If you haven’t been following the construction space like I have over the last two years you might not know that modular construction is blazing hot right now. Modular construction’s value proposition has been shorter construction times, lower upfront costs, and higher quality structures. The VC darling of the industry over the last few years has been Katerra, but they filed for bankruptcy in the first half of 2021, changed senior leadership (again), and have cut costs in its employee base. Katerra’s major technology push was in cross laminated timber (CLT), which is reliant on using adhesive to laminate boards together.

Cross Laminated timber falls into the category of engineered wood. You might know about engineered wood if you’ve ever used plywood, oriented strand board (OSB), particle board (hello IKEA), medium density fiberboard (MDF), glulam lumber, and laminated veneer lumber (LVL). Synthetic polymers such as phenolic resins (Hexion), amino resins (Hexion) polyurethanes (Ashland), and polymethylene diisocyanate (Covestro) are all options for holding engineered wood together. The whole concept of engineered wood is that it’s still mostly wood, but better for certain applications with the application of some engineering and chemistry.

Right now, it looks like Katerra will probably try to sell off the majority of its assets. Mercer International’s CEO David M. Gandossi spoke about it on their Q2 earnings call:

you will have likely seen the court filing about our stalking-horse bid for Katerra's Spokane, Washington, cross-laminated timber plant. We have agreed to a stalking-horse bid price of $50 million and a draft asset purchase agreement. Strategically, we feel this asset would be a material addition to our growing company and has the scale to be the first step of a significant pillar in our building products competency, particularly considering the expected growth in demand for [Indecipherable] timber construction

Katerra had secured a massive round of investment from Softbank at the end of 2020 at $200 million, but it has since eliminated about $3 billion in valuation in 2021. While I think Katerra had the pieces to put together modular housing at scale, the overall issue that they faced was actually putting the buildings up on the jobsite. Katerra had gone out and acquired a host of contractors in an effort to verticalize its operations, but I think the investors looking for software type growth in places like construction or chemicals need to re-evaluate their models.

Healthcare, construction, chemicals, and other highly regulated CAPEX intensive businesses have significant regulations in place to try and protect the public. Those same regulations can also stymie investors looking to ride a disruptive company’s valuation to the moon.

New and existing houses are not the only things that are more expensive. New and used cars are more expensive. Food is more expensive. If you live in Texas electricity is way more expensive. Hopefully, this is temporary.

Outlook For The Rest Of The Year

I expect prices to stabilize for the most part for raw materials as demand levels off at least here in the US. I suspect the delta variant will put a damper on fall and winter plans in areas without high vaccination rates. I think the rest of the year will be good for chemical companies with respect to profitability and this could be a great time for chemists and engineers to try and get a job in the industry.

I would just hold off on buying a house for now.