One big theme that I’ve tried to cover in this newsletter since its inception is the transition of our global materials economy from petroleum to biobased feedstocks. I covered how the majority of things we buy, consume, or use are dependent on crude oil previously by showing where our stuff comes from and the problems with alternatives.

The fundamental conundrum we (the chemical industry) find ourselves dealing with is trying to guarantee success prior to investing into the manufacturing facilities to scale-up. We can de-risk and evaluate the technical side for years with sending materials made in a lab to customers. Avantium has been doing this for a long time with polyethylene furanoate—a “new” (first polymerized in the 1970s) synthetic polymer that could replace polyethylene terephthalate (PET). The problem with the furan platform isn’t making the polymer, testing it, or demonstrating similar or better performance to PET, the standard plastic for a Coke bottle, but the supply chain needed to make it possible.

Origin Materials has an operational demonstration plant with the hopes of building a big plant (O2) for making chloromethyl furfural (also part of the Furan Revolution). Origin has this great graphic for all the chemists out there on how we can use furans to make either new stuff or stuff we already use.

Origin’s plans were/are to go from wood chips to CMF to para-xylene and let someone like Indorama take it the rest of the way to PET. They have since had to go down a different path and are commercializing a PET caps business. When I say caps, I mean the caps on PET bottles that hold your Diet Coke. By all appearances this is going really well for them. Origin appears to have developed a lot of core competencies around the PET supply and value chain, so this foray into caps and closures makes a lot of sense to me. For PET, it’s not just bottles, but any and all polyester which includes all of the clothing you might be buying and all of the polyester polyols used in flame resistant polyurethane foams, the global business is worth roughly $48.3 billion and while might seem a bit small touches almost every part of our lives.

Avantium wants to commercialize FDCA to make PEF and replace PET. With the right catalyst and process Avantium could in theory go from hydroxymethylfurfural (aka 5-HMF) to FDCA and with a biobased route to ethylene glycol or butane diol could be making PEF or PBF and either taking market share from PET or growing that $48.3 billion dollar business to be even bigger.

However, hydroxylmethylfurfural of 5-HMF is interesting on its own. There is an aldehyde that is quite reactive (maybe not as reactive as formaldehyde) and it also has a reactive hydroxyl group due to their close proximity to the very stable furan ring. Here are two reviews for the chemists and engineers reading: Advanced Materials and Industrial & Engineering Chemistry Research. The basic concept is to turn sugars into 5-HMF with high yield and purity at relatively mild conditions using strong acids and maybe a biphasic solvent system to minimize levulinic acid and humin formation.

In essence, the table is set for a furan revolution in chemicals. A lot of companies are ready to adopt furan-based chemicals. Coca-Cola has been ready since 2011. The problem is we don’t have easy access to any furans yet.

Michelin and ResiCare’s Investment into 5-HMF

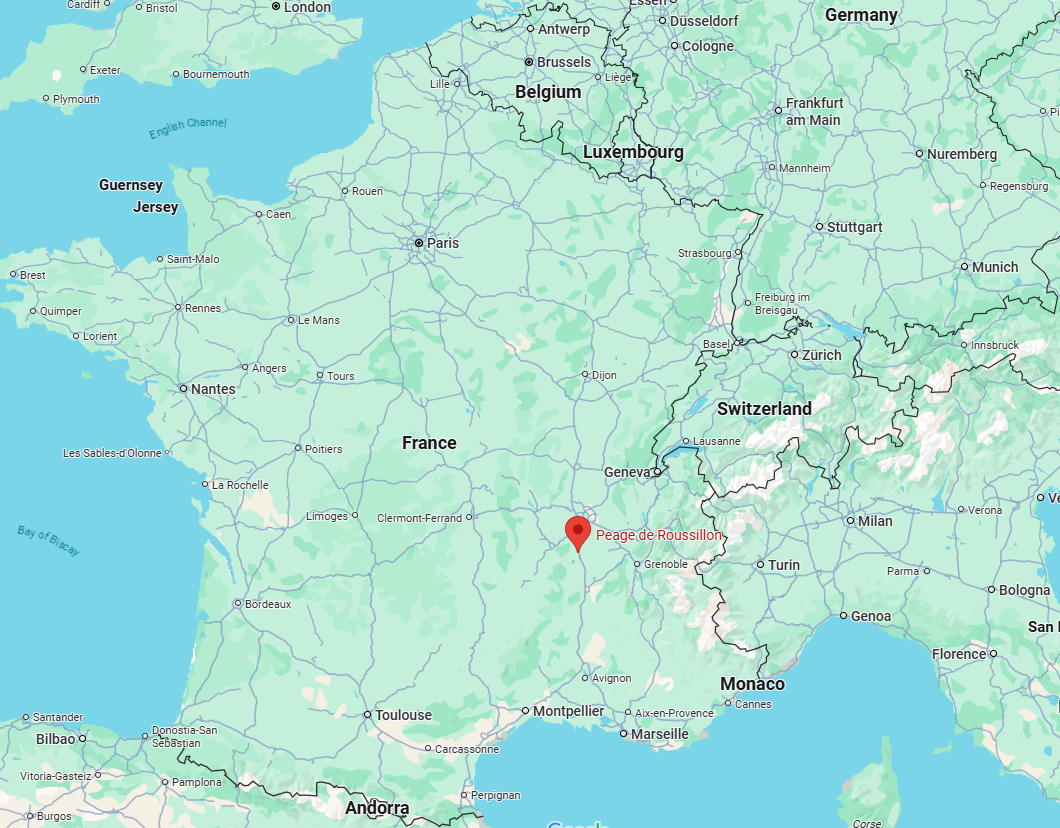

On May 23, 2025, Michelin and ResiCare announced the construction of a demonstration plant for 5-HMF in Péage en Roussillon, France. The goal is to have a production capacity of 3,000 metric tons per annum and it would be the largest 5-HMF site in the world when completed. A real demonstration plant. A total of 60 million Euros will be invested and partly subsidized (de-risked) by the French Agency for Ecological Transition (ADEME) and Circular Biobased Europe Joint Union (CBE JU).

The entire plant is based on a project called CERISEA and represents a global consortium of global chemical companies and research organizations interested in growing the 5-HMF supply chain and commercializing biobased chemicals. Of particular to note for me are Kraton, Avantium, Arkema, and Archer Daniels Midland. The consortium’s goal is to make the furan value chain become reality and ideally profit from it. Archer Daniels Midland (ADM) will be the supplier of sugar (fructose) for the project. I’d keep my eye on ADM since they seem to run one of the most successful biorefineries in France (biofuels).

I got a chance to catch up with Laurent Lemonnier, CEO of ResiCare, to talk about their investment and their vision for a biobased chemical future. In my experience if you want to have success in an area like this you need to have a vision of a future in 5, 10, and 15 years. Laurent has this vision with the goal of obtaining 5-HMF at demonstration plant quantities within the next 5-6 years. Laurent told me that ResiCare’s goal for 5-HMF is to see prices of less than 10 Euro/kg (~$4.5/lb) from this demonstration plant with a goal of pushing the price even lower as they scale up.

Laurent told me they will be using 5-HMF as a way to replace formaldehyde in phenolic resins and they are aiming for high value applications where cost is not necessarily a deal breaker. I agree only if there is a big advantage on performance or value. ResiCare’s primary targets are relatively small and niche, but with a 3000 ton/year production their targets are going to be limited anyway. Some examples of where high value phenolic resins would be welcome are in the space of brake pads (for racing), composites used in aerospace, carbon-carbon composites (airplane brake pads) and specific wood panels for shipbuilding.

It’s been about 7 years since I’ve made a phenolic resin, but my guess about using 5-HMF in either a novolac or resole system by replacing formaldehyde would be the following:

Enhanced rigidity/stiffness.

Higher glass transition and heat deflection temperatures.

Less thermal degradation at 500 and 800 degrees Celsius.

Higher carbon content when at 1000 degrees Celsius.

Better resistance to fire and reduced smoke generation.

The key piece of this will be ResiCare ensuring their customers are able to translate any advantage into increased performance. Since their formation from a few years ago I suspect that this value proposition might already be verified at the laboratory level and just needs confirmation at the demonstration plant level.

I expect Kraton and Arkema also have plans for how they will use 5-HMF in their own businesses and also need a demonstration plant capable of producing sufficient quantities for industrial scale validation testing with their own customers.

The revolution will not be televised, but it appears it will start in France.

It is quite interesting how Michelin comes to furan chemistry. They have previously developed adhesive compounds to replace recorcinol based resins used in the tire industry for adhesion for textile cords.Recently they were contacting companies if they would be interested in the FDCA and I saw slides, that they distribute. They offer it as a monomer for synthesis of polyester resins. As a replacement for formaldehyde, PF resins are far from been high value added application in general. And it is really hard to fight formaldehyde, that is roughly 1 euro/kg if you recalculate to the 100% active.

Tony; I will have to read again. One company that has been leading Furanic chemistry for the last 40 years or so is Pennakem https://pennakem.com/ not a flashy start-up, but they have running plants. There are also the Furfural producers, but I don't think they take the molecules too far.

There is a lot of promise in furanics, but we don't seem to be able to drive it to high production rates and low costs. Answering the comment below, under the current business model PEF is a specialty and so is FDCA. Not price matching for some time, if at all. But it may not be needed.